Nigeria’s state-owned oil company, NNPCL, disbursed N424 billion ($283 million) to the federation account as part of its production sharing agreement obligations, amid rising oil revenue collections.

This disclosure is contained in a newly released World Bank report on Nigeria’s development update obtained by Energy in Africa.

According to the report, the national oil firm released the amount between January and August 2025.

It also revealed that NNPCL did not allocate any interim dividends to the federation within the same period.

The federation’s share of NNPC’s production sharing contract (PSC) has increased recently, boosted by the gains of subsidy removal.

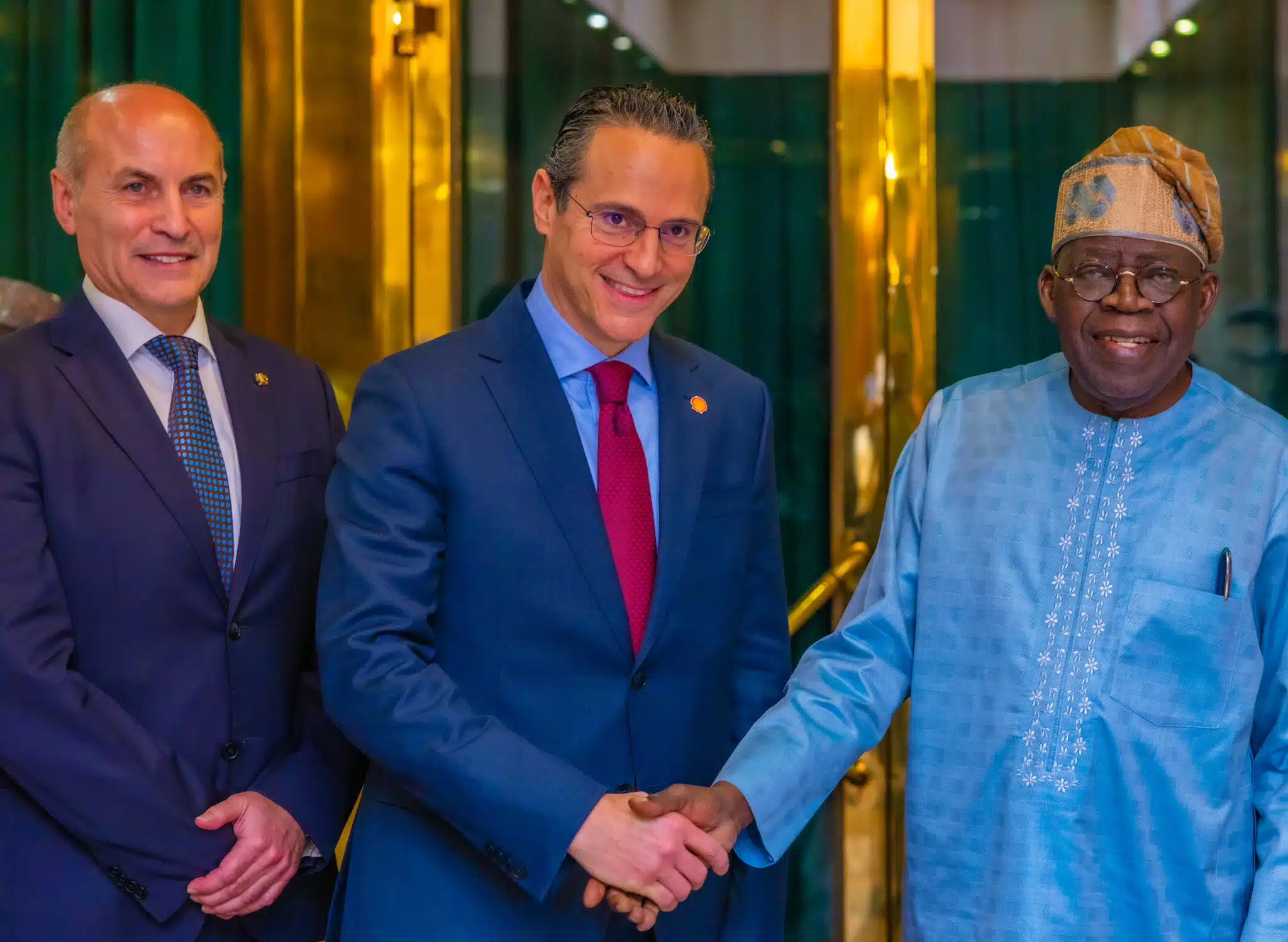

Nigeria’s president, Bola Tinubu, scrapped the long-standing but costly fuel subsidy in May 2023, triggering a cost-of-living crisis across the country.

At the time of removal, the subsidy was draining about $10 billion (N15.1 trillion) annually from the federation account.

This figure was higher than the government’s combined allocations to education, agriculture, and defence.

Meanwhile, subsidy removal boosted government revenues through the federation account allocation (FAAC).

“This was supported by higher oil production and revenue gains from the removal of the PMS subsidy, partly transmitted to the Federation early in the year.

“These gains strengthened Nigeria’s fiscal resilience, enabling all tiers of government to expand spending,” the World Bank report says.

Other gains from oil revenue

The report further shows that total oil revenues within the period rose to N10.7 trillion ($7.14 billion), compared to N8.3 trillion ($5.54 billion) recorded in the same period of 2024.

Breaking it down, most government oil revenues came from oil and gas taxes.

Closely behind taxes were oil and gas royalties, which amounted to about N4.8 trillion ($3.21 billion).

Other inflows from the sector included gas flaring penalty fees, rentals, and miscellaneous charges.

The report notes that the marginal rise in oil revenue was driven by higher oil production rather than sustained high oil prices.

Nigeria’s oil output has recently climbed from about 1.2 million barrels per day (bpd) to a record 1.6 million bpd.

“Gross oil revenues increased by 0.1 percentage points of GDP in 7M-25, despite a 14.6% y/y decline in oil prices.

“This was supported by higher oil production…” the report says.

Nigeria’s production gains have been fueled by a crackdown on oil theft, renewed investor confidence, and increased exploration in the upstream sector.

The Group Chief Executive Officer of NNPCL, Bashir Ojulari, said the company’s target is to raise production to 2 million bpd before the end of 2025.

According to him, output could reach 3 million bpd by 2027.