British oil major, Shell Plc, is not a new player in Nigeria’s oil and gas sector. The company has been drilling oil on the West African shore since the 1960s.

For decades, Shell was synonymous with Nigeria’s petroleum story, controlling a significant share of the country’s oil assets and pioneering offshore production.

But the relationship reached its lowest point between 2015 and 2022.

During that period, Shell’s onshore operations became increasingly burdened by persistent insecurity, widespread pipeline sabotage, crude theft, a web of legal disputes, both at home and abroad.

What was once a cornerstone of its African portfolio became a liability that proved difficult to manage.

Unable to contain the scale of its challenges, Shell exited Nigeria’s onshore and shallow water operations, the oldest privately operated oil assets in the country’s history.

The divestment, valued at about $2.3 billion, marked the end of a more than seven decade presence onshore and signalled a strategic retreat from the Niger Delta terrain that had become commercially and legally fraught.

Yet, Shell did not leave Nigeria. Instead, it held on firmly to its offshore and gas assets.

It is within these assets deep offshore oil and integrated gas that Shell has chosen to place its renewed bet on Nigeria, buoyed by policy reforms, improved regulatory clarity and a political push to restore investor confidence.

Over the past two years, that bet has translated into capital commitments rarely seen in Nigeria’s oil and gas sector in more than a decade.

Shell has taken final investment decisions, expanded its offshore footprint and publicly pledged long term capital deployment, positioning itself once again at the centre of Nigeria’s oil revival.

In just over a year, Shell and its subsidiaries have committed nearly $7 billion to new offshore oil and gas projects. The company also said it is prepared, alongside its partners, to invest as much as $20 billion more.

For a sector long starved of fresh capital, Shell’s renewed appetite has stood out.

What’s driving Shell’s new investment in Nigeria

At the core of Shell’s renewed confidence is Nigeria’s evolving policy and fiscal landscape.

The Petroleum Industry Act (PIA), alongside targeted executive and regulatory measures, has reshaped the economics of deep water oil and gas investments.

Beyond the PIA, the federal government has introduced investment-linked incentives tailored specifically to unlock large offshore projects.

These incentives are restricted, tied to incremental production, local content delivery and in country value addition, rather than blanket concessions that erode government revenue.

Security improvements have also played a role.

While onshore assets remain exposed to vandalism and theft, offshore developments operate in a more controlled environment, reducing operational risks and making capital intensive projects more attractive to investors.

For Shell, these changes have altered the investment equation. According to its CEO Weal Sawan, Nigeria is now among the countries attracting significant interest from international oil companies.

Shell deepens engagement with Nigeria’s government

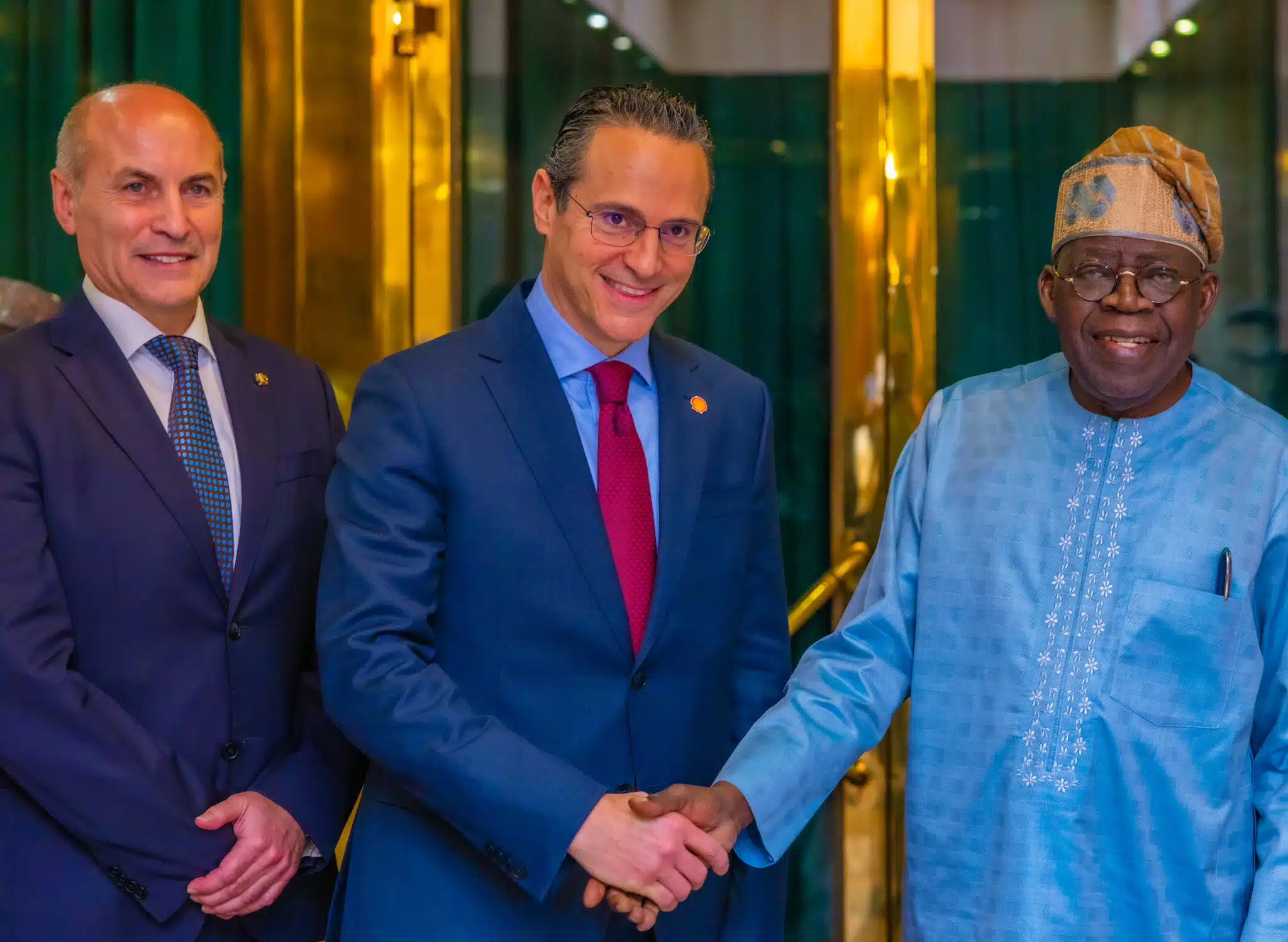

The shift in Shell’s relationship with Nigeria’s political leadership has also been visible. Recently, Sawan, led a delegation to Aso Rock, where he met President Bola Tinubu to discuss offshore investments and long term capital plans.

He is the only oil major CEO that has met the president since his begining of his administration in 2023.

During the meeting, Sawan credited the Tinubu administration with restoring investor confidence, noting that Shell’s renewed willingness to commit capital had not always been the case.

He said the administration’s leadership and vision had created an environment that compared favourably with other investment destinations globally.

Moreover unlike other oil firms, Shell’s recommitment has been reinforced by concrete deals.

One of the most notable is the $2 billion HI offshore gas project, developed in partnership with Nigerian firm Sunlink Energies and Resources Limited.

The project, located in OML 144, is designed to supply up to 350 million standard cubic feet of gas per day to Nigeria LNG.

The HI project aligns with Nigeria’s gas led transition strategy and Shell’s global push to expand its LNG portfolio.

Gas from the field is expected to feed NLNG’s Train 7 project, strengthening Nigeria’s position in the global LNG market while supporting domestic economic objectives.

The west Bonga project

Shell’s offshore ambitions are driven by the Bonga complex.

In April, last year the company announced a $5 billion investment in Bonga North, one of Nigeria’s largest deep water oil projects. It also acquired TotalEnergies’ stake in the block for $530 million, deepening its interest in OML 118.

Beyond Bonga North, Shell is advancing plans for the Bonga South West project.

According to the company, the project could attract up to $20 billion in foreign direct investment if it reaches final investment decision, with roughly half deployed as capital expenditure and the remainder flowing into operating costs within Nigeria.

President Tinubu said he has approved the issuance of targeted incentives to support Bonga South West, describing the project as strategic to job creation, foreign exchange inflows and long term government revenue.

Tinubu also said he wants the project to reach a FID before the end of his first term, which will be in 2027.

On its part, Shell described Bonga South West as one of the largest prospective energy projects globally. For Nigeria, it represents a pathway to sustaining offshore production, deepening local participation in offshore engineering and reinforcing the country’s export revenue base.

Shell isn’t the only one in the pack

To be fair to all parties, Shell is not the only one riding th wave of the West African’s nation oil boom.

ExxonMobil, for instance, has announced plans to invest up to $10 billion in Nigeria’s offshore sector over the next five years.

TotalEnergies and Eni have also signalled continued interest in deep water and gas developments, even as they streamline their portfolios.

Chevron, another long standing operator, has similarly scaled back its onshore footprint while maintaining offshore interests. Together, these moves have shifted the centre of gravity of Nigeria’s oil industry further offshore, where capital intensive projects dominate and only deep pocketed investors can participate.

However, while several firms have made pledges, Shell remains the most visible in terms of executed investments. Recent estimates suggest Nigeria has attracted about $8 billion in oil and gas investment in the past year, with nearly $7 billion linked directly to Shell and its subsidiaries.

How sustainable is Shell’s new relationship

The durability of Shell’s renewed relationship with Nigeria will depend on policy consistency, regulatory speed and the ability to sustain investor confidence beyond headline announcements.

Deep water projects require long planning cycles and capital commitments that span decades.

Shell has made clear that its investments are long term, not tied to a single political cycle. Stability, regulatory certainty and disciplined incentives remain continues to shape it’s investment decisions.

For now, Shell’s actions suggest a decisive shift from retreat to recommitment. In an industry still cautious about Nigeria, the company has emerged as the clearest signal that the country’s offshore oil and gas sector may be entering a new chapter.