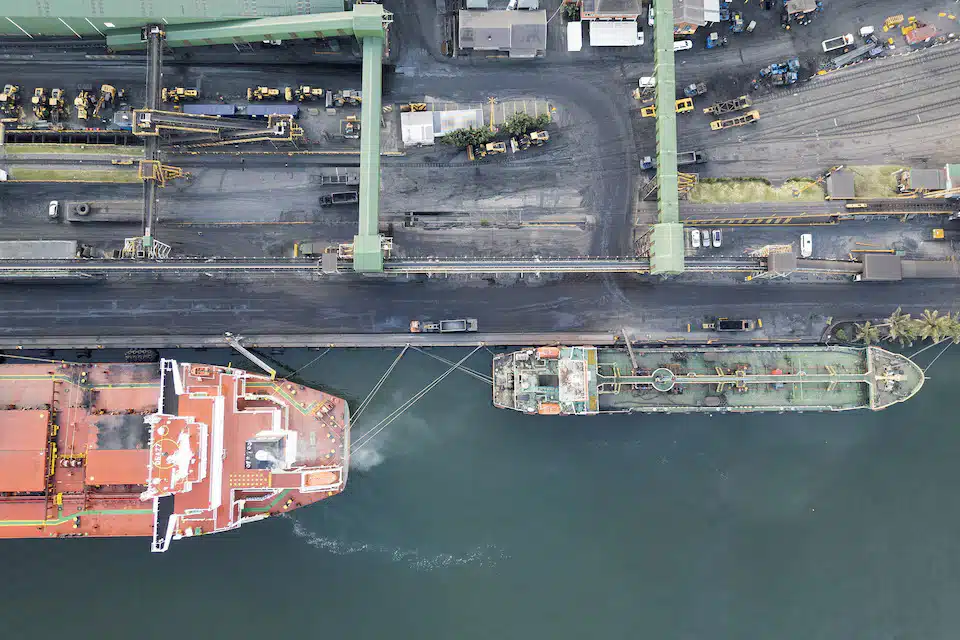

When the Abo field began producing oil in 2003, Nigeria crossed a historic frontier. For the first time, the country was extracting crude from deepwater reserves—far offshore, where engineering challenges are immense and costs daunting.

At the centre of this breakthrough was the Abo FPSO (Floating Production, Storage and Offloading unit), a converted tanker that became the beating heart of Nigeria’s deepwater ambitions.

As Nigeria’s first deepwater production asset, Abo marked the country’s entry into the league of nations capable of harnessing hydrocarbons from the ocean floor. The FPSO achieved “first oil” for Nigeria’s deepwater sector.

Two decades later, the pioneering vessel still floats in the swells of the Niger Delta, but its story has shifted from bold beginnings to questions of legacy, ownership, and relevance.

The legacy of Abo FPSO

The Abo field, located in Oil Mining Lease (OML) 125 about 40km offshore Akwa Ibom, lies in water depths of 550–1,100 metres.

Originally discovered by ExxonMobil and later transferred to Eni, the block spans 1,983km² and includes three fields—Abo, Abo North, and Okodo. It produces light, sweet crude oil (API gravity 39°–41°) and natural gas.

Production involves eight producing wells, two water injection wells, and two gas injection wells tied to the Abo FPSO. Eni contracted BW Offshore (then ProSafe) in 2002 to convert the 1976-built Suezmax tanker Gray Warrior at Keppel Shipyard in Singapore.

The conversion was completed in just 10 months—a remarkably fast turnaround for a deepwater facility. Subsea work was carried out by Saipem and Technip.

By April 2003, Abo became Nigeria’s first-ever deepwater producer, proving the country’s offshore viability and paving the way for later projects such as Bonga and Erha.

At launch, the FPSO had the following capabilities:

- crude processing capacity of 45,000 barrels per day

- gas handling of 44 million cubic feet per day

- storage for 930,000 barrels

Oando made history with Abo

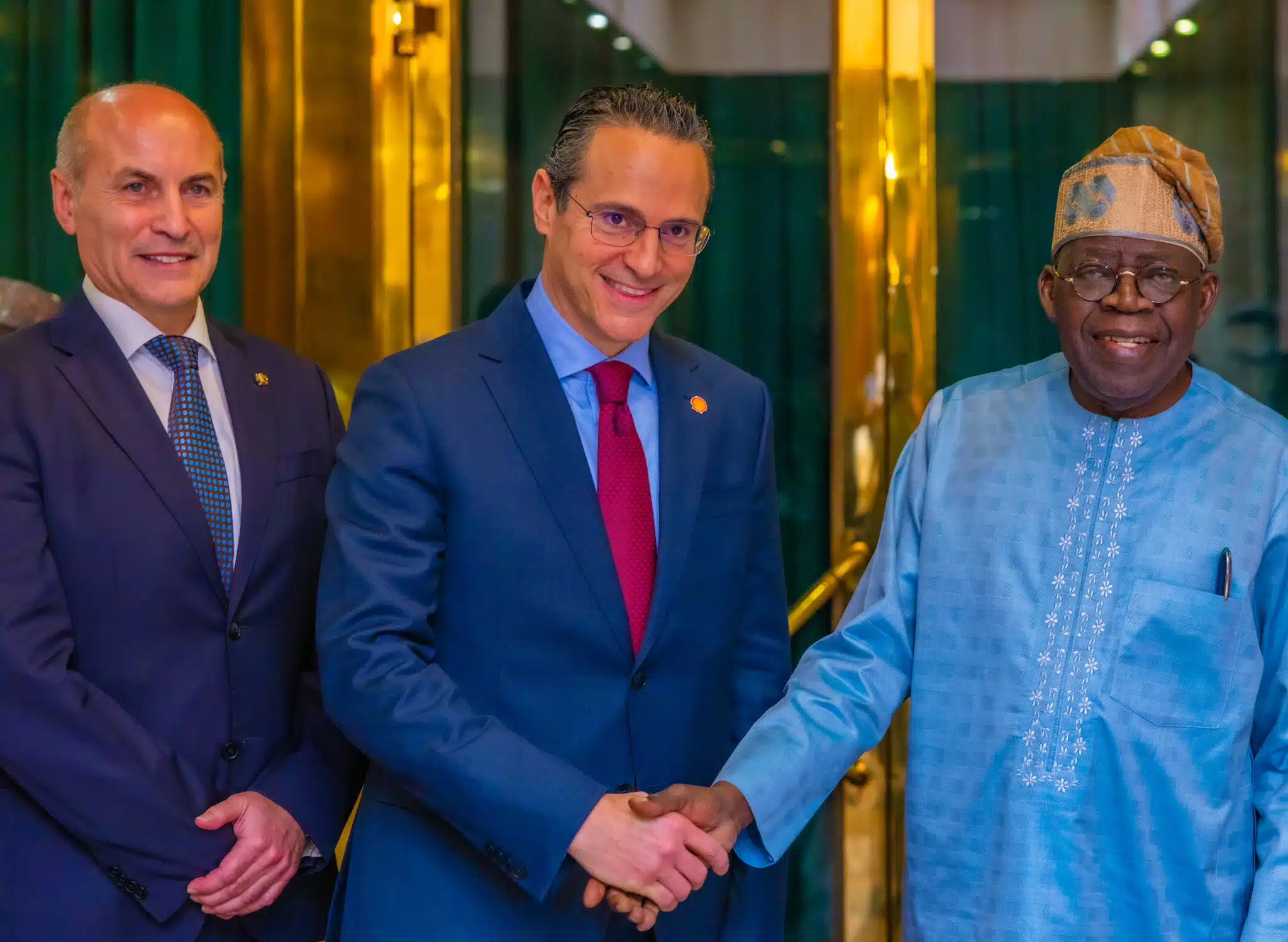

In 2009, Oando Energy Resources acquired a 15% stake in OML 125 from Shell, becoming the first indigenous company to participate in a producing deepwater asset. Shell divested its 49.8% non-operated stake to Oando and Eni to focus on its Bonga project, raising Eni’s operating stake to 85%.

Oando’s chief executive Wale Tinubu said: “Yet another testament to the coming of age of Indigenous Corporates in the challenging arena of the Upstream Oil Industry.

“This is a significant milestone for Oando as we officially join the league of companies with interests in deep offshore producing assets. This acquisition will contribute to our strategic target of 100,000 bpd by 2012, as we continue to explore opportunities to build a robust portfolio of oil and gas properties.”

At the time, the Abo field was producing about 32,000 barrels per day, with crude sold to Shell in London under an exclusive agreement.

The field reached peak production in 2010, with nearly 68% of recoverable reserves already extracted. Production is expected to reach its economic limit in 2053.

Operators over the years

BW Offshore operated the FPSO from 2003 until September 2023, when it sold the vessel for $20 million to STAC Marine Offshore Limited, part of a Nigerian shipping group. BW described the move as part of its divestment of “non-core” and ageing assets.

To ensure smooth transition, BW arranged a two-month bareboat charter before STAC assumed full control.

BW Offshore stated: “As part of the transaction, BW Offshore has entered into a bareboat charter with STAC to allow for uninterrupted operations for the client during a transition period of maximum two months. Upon expiry of the bareboat charter, STAC will assume responsibility for operations of the unit.”

Following acquisition, STAC invested 500,000 manhours in repairs, steel renewal, and equipment upgrades. The vessel was renamed FPSO Mayo Abo under the Panama flag and continues to support production in OML 125.

A national pacesetter yet with local content challenges

Abo set new technical benchmarks for Nigeria’s offshore industry, introducing advanced subsea systems, flexible pipelines, and FPSO mooring technology.

It laid the foundation for later deepwater assets including:

- Bonga FPSO (Shell)

- Akpo FPSO (TotalEnergies)

- Agbami FPSO (Chevron)

- Egina FPSO (TotalEnergies)

- Erha FPSO (ExxonMobil)

- Sea Eagle FPSO (Renaissance Group)

- Usan FPSO (ExxonMobil)

- Abigail-Joseph FPSO (First E&P)

Around 80% of Nigeria’s deepwater production comes from FPSOs.

Although the Abo and other FPSOs that followed have helped build local expertise in deepwater engineering, deepwater operations remain dominated by international oil companies due to the technical and financial demands.

Nigeria’s oil minister Heineken Lokpobiri recently said: “Our field is big enough for both EPC companies and the local companies to coexist. Do you agree with me that the local companies today cannot do any work in offshore exploration?

“That remains within the exclusive capacity of EPC. And most of the time when I engage members of EPC, they will tell me their approach and concept is higher because they seem to be a monopoly.”

Shell’s managing director Ronald Adams added in August 2025: “The question is no longer whether Nigeria will play a key role in the future of energy, but how quickly and effectively we can harness our potentials to deliver affordable, secure, and increasingly cleaner energy for Nigeria, and the world.”

To help address the challenge, the company in August 2025 said it was aiming to execute over 90% of its contract value through indigenous players.

“A lot more needs to be done to scale up local competence. End-to-end industrial capability is limited in Nigeria, which means project scopes often get split between in-country and overseas, increasing cost and in some cases delaying delivery,” Ronald Adam said.

Shell operates Nigeria’s second-oldest and one of the country’s largest deepwater assets (Bonga FPSO) and has two multibillion-dollar deepwater oil projects currently under development, including the Bonga North tie-back and the long-delayed Bonga South West Aparo (BSWA) project. BSWA will require a new-build FPSO.

The future of FPSO Mayo Abo

Since STAC took over, production has risen modestly from 10,000 barrels per day in late 2023 to nearly 12,000 barrels per day in 2024—well below the vessel’s 45,000 bpd capacity.

Eni has extended its production-sharing agreement with NNPC for the Abo field another 20 years, including deals to acquire other assets related to OML 125.

This was the second such effort on the block since 2013 when the Italian major kicked off the third phase of development (backed by 4D seismic surveys) to extend the life of the field.

Last year, Eni said reforms in the Nigerian oil sector had helped boost output from the Abo field by 20%, adding “for the first time in decades” Eni was producing above budget in Nigeria.” The actual volume was not disclosed.

Still, analysts warn the vessel—already 50 years old and repurposed twice—faces structural fatigue and may not survive much longer before being scrapped.

For now, FPSO Mayo Abo continues to make marginal contributions to Nigeria’s oil output, remaining a symbol of the country’s deepwater ambitions.