When Bashir Ojulari stepped in as the new Group CEO of NNPC Limited in April 2025, many Nigerians didn’t just see a leadership change; they expected reforms in an energy institution long plagued by opacy, secrecy, and absence of public trust.

His appointment followed months of growing public outrage over the tenure of his predecessor, Mele Kyari, who had led the national oil giant since 2019.

Though Kyari was lauded in some quarters for overseeing NNPC’s transition into a limited liability company, his later years were filled by controversy, culminating in accusations of self-enrichment, corporate opacity, and widespread discontent.

In the midst of the controversy were reports that Kyari and NNPC’s Chief Financial Officer, Umar Ajiya, awarded themselves billions of naira in gratuities, while still in service.

Critics called this a breach of public service ethics, and some insiders described it as an act of “treating NNPC like a personal business.”

As oil prices surged globally, Nigerians at home were instead battling chronic fuel scarcity, long queues, and skyrocketing pump prices.

These woes were worsened by revelations that NNPC was spending billions importing fuel while local refineries remained comatose, despite huge rehabilitation budgets.

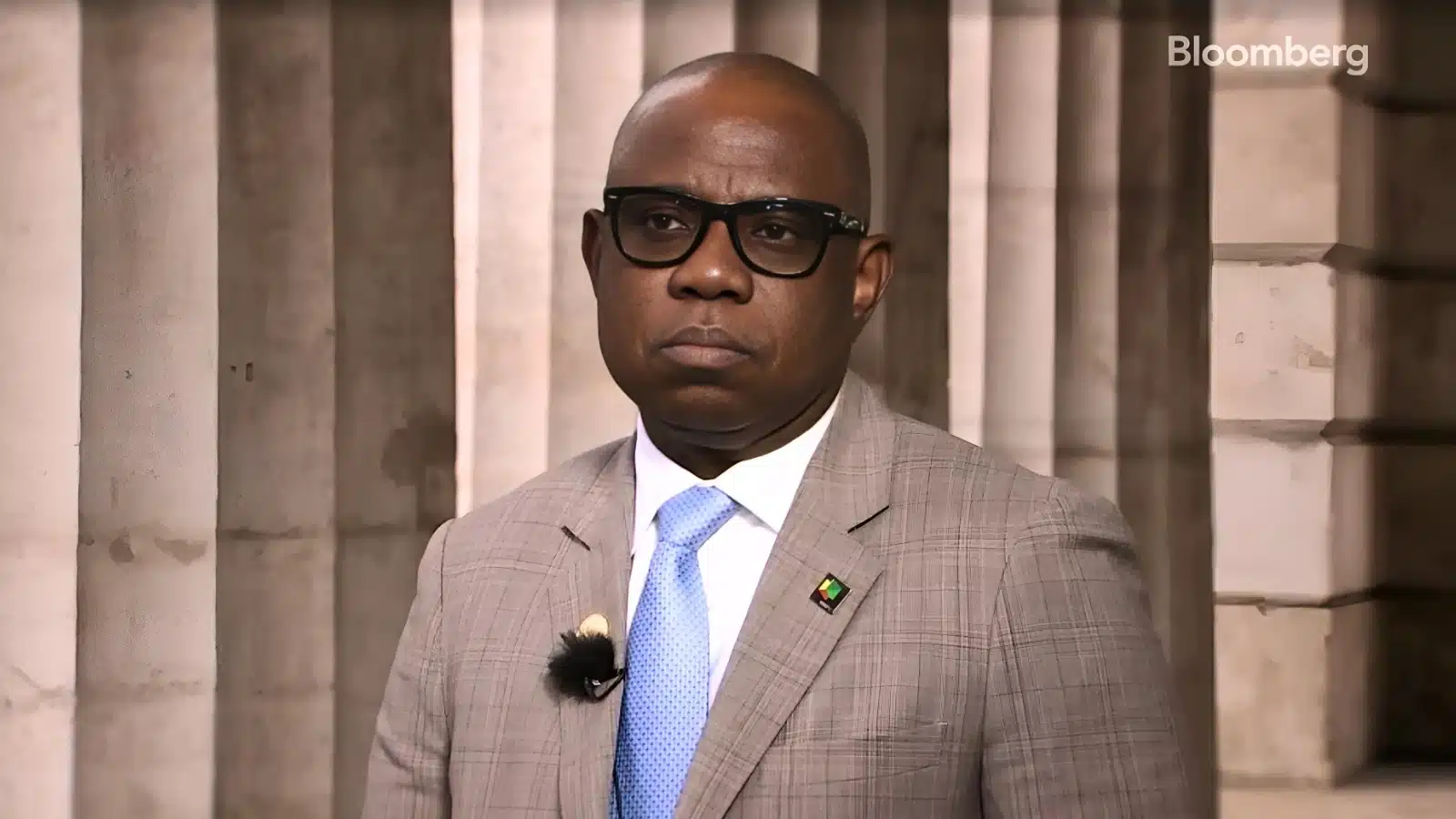

In a bold move backed by law, President Bola Tinubu on April 2, 2025, replaced the entire NNPC board and appointed Bayo Ojulari, a former Shell executive, as the new Group Chief Executive Officer of NNPC Ltd.

Early shake up of oil firm

In his desire to see positive changes in the company, President Tinubu charged the new NNPC leadership with reviewing its operated and jointly owned assets across the country to ensure alignment with value maximization objectives.

Also, the company was asked to increase its crude oil refining output to 200,000 barrels per day (bpd) by 2027 and 500,000 bpd by 2030.

In his first town hall with staff, Ojulari set ambitious targets including reaching;

- $30 billion investment by 2027, rising to $60 billion by 2030;

- 2 million bpd oil production by 2027, 3 million by 2030;

- 10 bcf/d gas by 2027, moving toward 12 bcf/d by 2030.

“We stand at the gateway of a new era; one that demands courage, professionalism, and a relentless drive for excellence,” he declared.

Just days after taking over, Ojulari swiftly fired the Managing Directors of Port Harcourt, Warri, and Kaduna refineries over what he describes as value erosion, instead initiating monthly operational reviews for improvements.

He formed a rapid-response assessment team under NNPC’s VP downstream to evaluate plant conditions and operational readiness.

The executive has shown commitment to transparency in releasing NNPC’s long-absent monthly operational data for April 2025, reporting N5.89 trillion revenue and N748 billion profit.

He has since gone on to announce similar reports for April, May and June 2025.

Progress in production and infrastructure

Under his watch, crude oil production met and crossed the OPEC quota of 1.5 million bpd in June, with a target to reach 1.9 million bpd by year-end.

Aside from oil, gas production has also been growing consistently, reaching an impressive volume of 7,581 million standard cubic feet per day (mmscfd) in June. That is the highest monthly figure seen so far in 2025.

Gas sales also saw a historic rise in June since the start of the year.

In the last three months, NNPC has restarted and made progress on key infrastructure projects that were stalled for some reasons by the previous leadership.

This includes:

- Resumption of construction work on the Ajaokuta‑Kaduna‑Kano (AKK) pipeline, pushing it from 72% completion in Q1 2025 to 83% in June 2025, with River Niger crossing achieved.

- Resumption of drilling in the Kolmani field in Northern Nigeria, potentially unlocking up to 1 billion barrels of crude oil and 500 billion cubic feet of natural gas.

- NNPC achieved a near 100% operational uptime of its upstream pipeline in June, suggesting continued improvements in security and infrastructure stability.

Challenges ahead

Despite significant optimism in the last 100 days under Ojulari, key refineries remain under review and the fate of state-owned assets is uncertain.

Ojulari, while fielding questions from a Bloomberg interview earlier this month, admitted that selling refineries remains an option, depending on review outcomes.

“We made quite a lot of investment in our refineries over the last years. We brought in a lot of technologies. We’ve been challenged as some of those technologies have not worked as we expected so far.

“But what we are saying is that sale is not out of the question. All the options are on the table, to be frank. But that decision will be based on the outcome of the reviews we are doing now,” Ojulari said.

Also, public trust remains fragile. NNPC has long faced criticism over debt, opacity, and executive inertia. Industry experts warn that sustained reform will hinge on transparency and execution.

In this regard, the new NNPC boss began releasing a monthly report that provides key insights into the company’s operational and financial performance. This was last done in 2021.

Another concern has been the cost of oil production which remains high. Ojulari recently acknowledged the high operating cost per barrel ($25–30 per barrel), which he said was due to prior underinvestment in pipelines and security infrastructure.

Future outlook

The appointment of Ojulari to lead the NNPCL board mark one of the two most significant shake-ups in Nigeria’s oil and gas sector under President Tinubu’s administration, having previously removed subsidies on petrol.

Although the move to replace the old NNPC board started out quite rocky, it is seemingly working well so far due largely to:

- Already established clear fiscal and regulatory reforms.

- Improved operational visibility through prompt data release and financial disclosures.

- Positive momentum in upstream and midstream projects combined with realistic production targets.

These important steps have helped make Ojulari’s first 100 days at the helm of the state-owned company bold and transformative on many fronts.

He has set clear targets, reshuffled leadership and reintroduced the much needed transparency.

Yet, the path forward involves navigating complex refinery realities, securing sufficient capital, and sustaining stakeholder confidence.