In recent years, the global demand for lithium—a critical component in rechargeable batteries—has surged, driven by the rapid adoption of electric vehicles (EVs), renewable energy storage solutions, and a myriad of electronic devices.

This escalating demand has ignited a fervent quest for lithium resources worldwide, with Africa emerging as a focal point due to its abundant untapped mineral wealth.

Among African nations, Nigeria stands out, not only for its significant lithium deposits but also for its strategic initiatives aimed at harnessing this resource to establish itself as a key player in the global battery industry.

Historically, Nigeria’s economy has been heavily reliant on oil exports, rendering it vulnerable to the volatile dynamics of the global oil market.

Recognizing the imperative for economic diversification, the Nigerian government has turned its attention to the solid minerals sector, with lithium mining and processing taking center stage.

The discovery of substantial lithium deposits in states such as Nasarawa has positioned Nigeria to potentially become a significant contributor to the global lithium supply chain.

Nigeria’s lithium boom: Opportunities and challenges

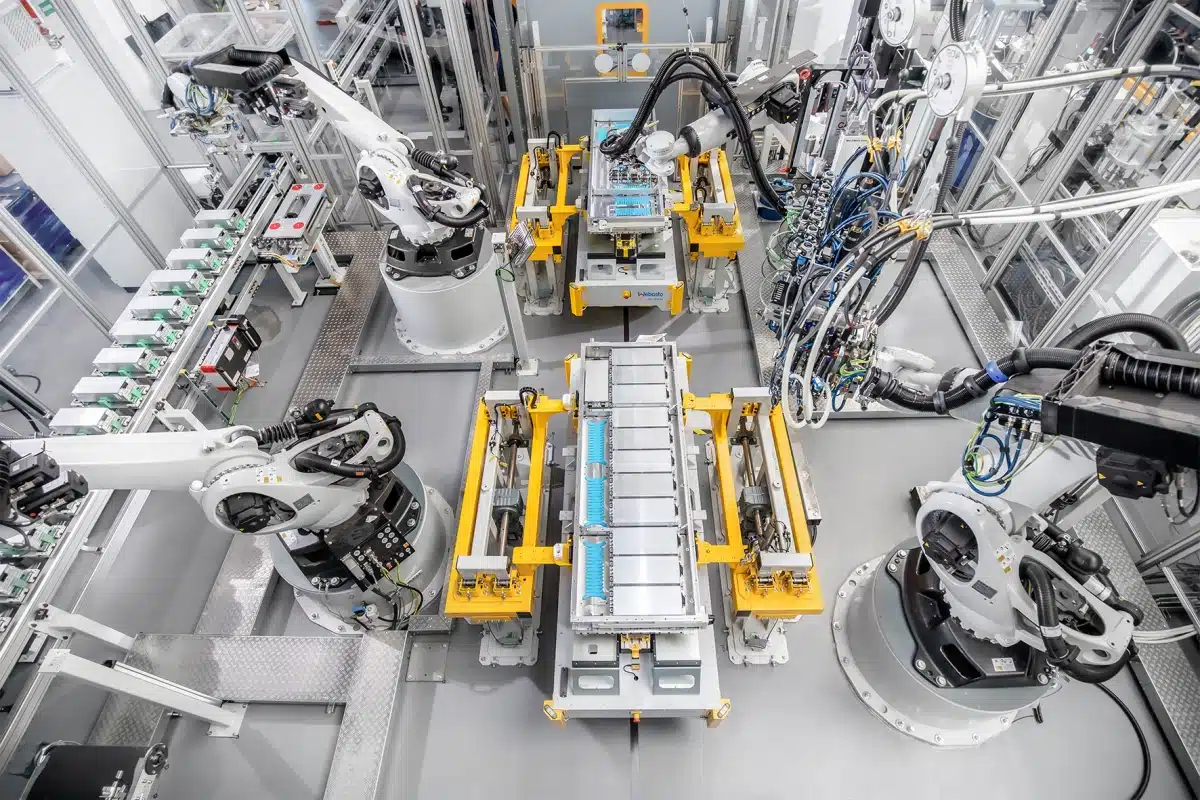

In May 2024, a landmark development underscored Nigeria’s commitment to this vision: the inauguration of the country’s largest lithium processing plant in Nasarawa State.

Constructed by the Chinese firm Avatar Energy Materials Company Limited, this facility boasts an impressive capacity to produce approximately 4,000 metric tonnes of processed lithium daily.

The significance of this venture was further amplified by Canmax Technologies, a prominent Chinese company responsible for over 30% of global battery material production, announcing a substantial investment of $200 million for an additional lithium processing plant in the same region.

These developments not only highlight Nigeria’s rich lithium potential but also its attractiveness to foreign investors seeking to capitalize on the burgeoning battery market.

However, the path to establishing Nigeria as a global battery powerhouse is fraught with challenges. The burgeoning lithium mining industry has brought to light pressing ethical and environmental concerns. Reports have surfaced of illegal mining operations, with vulnerable populations, including children, being exploited under hazardous conditions.

In Nasarawa’s Pasali community, for instance, children as young as six are engaged in perilous mining activities, earning meager wages and often at the expense of their education.

These practices not only contravene international labour laws but also pose significant health risks to the individuals involved.

Furthermore, the global lithium market is characterized by its volatility. After experiencing a significant boom, lithium prices witnessed a sharp downturn due to an oversupply and lower-than-anticipated demand for EV batteries.

While analysts remain optimistic about the long-term prospects of lithium, driven by governmental mandates promoting EV adoption, the immediate future presents uncertainties.

This volatility underscores the importance of strategic planning and market analysis for countries like Nigeria aiming to enter the lithium market.

Despite these challenges, Nigeria’s government has demonstrated a proactive stance. In March 2024, the Federal Government unveiled plans to establish an indigenous lithium battery factory, aiming to reduce the nation’s dependency on foreign production and foster local manufacturing of vital energy storage components.

The Minister of Science and Technology, Uche Nnaji, emphasized the significance of this initiative, highlighting the country’s commitment to leveraging its mineral resources for technological advancement and economic growth.

Other African countries

Moreover, Nigeria’s lithium ambitions are not occurring in isolation. Across Africa, countries like Zimbabwe and the Democratic Republic of Congo are also making significant strides in the lithium sector.

Zimbabwe, for instance, has attracted over $1 billion in lithium investments since 2021, primarily from Chinese battery metal companies. The nation is moving forward with a $270 million lithium project, anticipating that global lithium prices will justify the investment.

As the global community intensifies its shift towards sustainable energy solutions, the strategic importance of lithium is set to escalate further.

For Nigeria, this presents a dual opportunity: to position itself as a pivotal player in the global battery supply chain and to drive economic diversification and development domestically.

However, realizing this potential necessitates a balanced approach that addresses ethical, environmental, and economic considerations.

By implementing robust regulatory frameworks, fostering responsible mining practices, and investing in value-added processing capabilities, Nigeria can navigate the complexities of the lithium rush and emerge as a global battery powerhouse.

Africa’s emerging role in global lithium landscape

The global energy landscape is undergoing a transformative shift, with a pronounced move towards renewable energy sources and electric mobility. Central to this transition is lithium, a lightweight metal integral to the production of high-capacity rechargeable batteries.

As the demand for electric vehicles (EVs), portable electronics, and energy storage systems surges, the global appetite for lithium has intensified, leading to what many term the “lithium rush.”

Historically, lithium production has been dominated by countries such as Australia, Chile, and China.

However, the finite nature of these resources and the geopolitical complexities associated with them have prompted a global search for alternative sources. Africa, with its vast and largely untapped mineral reserves, has emerged as a promising frontier in this quest.

Several African nations have identified significant lithium deposits within their borders. Zimbabwe, for instance, has been at the forefront, attracting substantial investments in its lithium sector.

Another notable development in Zimbabwe is the planned $270 million lithium project, which underscores Zimbabwe’s commitment to capitalizing on the global demand.

Despite recent fluctuations in lithium prices, analysts forecast stability driven by robust EV sales, particularly in China.

Trevor Barnard, CEO of Kuvimba Mining House, expressed optimism about the market’s trajectory, stating that while prices may not return to their 2022 peaks, a recovery is anticipated in the near future.

A lesson from DRC

The Democratic Republic of Congo (DRC) is another African nation with significant lithium potential. Known for its rich mineral wealth, the DRC has historically been a major supplier of cobalt, another essential component in battery production.

The country’s Katanga region is now at the center of a global race to secure resources vital for the decarbonization revolution, including lithium. Both the United States and China have shown keen interest in the DRC’s mineral resources, highlighting the nation’s strategic importance in the global energy transition.

On its part, DRC vast lithium and cobalt reserves have made it a battleground for geopolitical influence, with both superpowers vying for control over these critical minerals.

China has already established a strong foothold through extensive investments in mining infrastructure and long-term agreements with Congolese mining companies.

Companies like Zhejiang Huayou Cobalt and China Molybdenum have secured significant stakes in the country’s lithium and cobalt mines, ensuring a steady supply for their domestic battery industries.

On the other hand, the U.S. and its allies are working to counterbalance China’s dominance by forging new partnerships with African nations.

The U.S. has emphasized the importance of creating a more diversified and ethical supply chain for battery minerals, particularly as the world moves towards green energy.

In 2023, the Biden administration launched the Minerals Security Partnership (MSP), a global initiative aimed at securing sustainable mineral supply chains by collaborating with resource-rich countries like the DRC.

Through agencies like the U.S. International Development Finance Corporation (DFC), Washington has pledged financial support for mining projects that adhere to high environmental, social, and governance (ESG) standards.

However, the DRC faces significant challenges in leveraging its mineral wealth for national development. Issues such as political instability, corruption, and illicit mining activities have hindered efforts to establish a transparent and sustainable lithium industry.

Additionally, concerns about human rights violations, including child labour in mining operations, have led to increased scrutiny from international watchdogs.

If the DRC can implement stringent regulations and ensure ethical mining practices, it has the potential to become a leading supplier of lithium and other battery minerals in the global market.

Back to Nigeria’s context

For Nigeria, the experiences of countries like the DRC and Zimbabwe offer valuable lessons.

The lithium rush offers a chance for economic transformation, but a strong regulatory framework is essential.

Clear policies can help prevent resource exploitation and promote environmental sustainability.

Maximizing value addition through local processing and manufacturing will ensure long-term benefits.

Nigeria’s efforts to attract foreign investment must be balanced with strong governance to avoid the pitfalls of resource mismanagement that have plagued other African nations.