The post-subsidy era of petrol pricing in Nigeria has taken a dramatic turn as the country’s two major oil companies—the Nigerian National Petroleum Corporation (NNPC) Limited and the Dangote Refinery—now engage in a quiet price war to capture a larger share of the market.

The fight for market dominance has led to a shift in pricing, which surged by as much as 400% in May 2023 when newly elected President Bola Tinubu suddenly removed the costly but widely supported petrol subsidy.

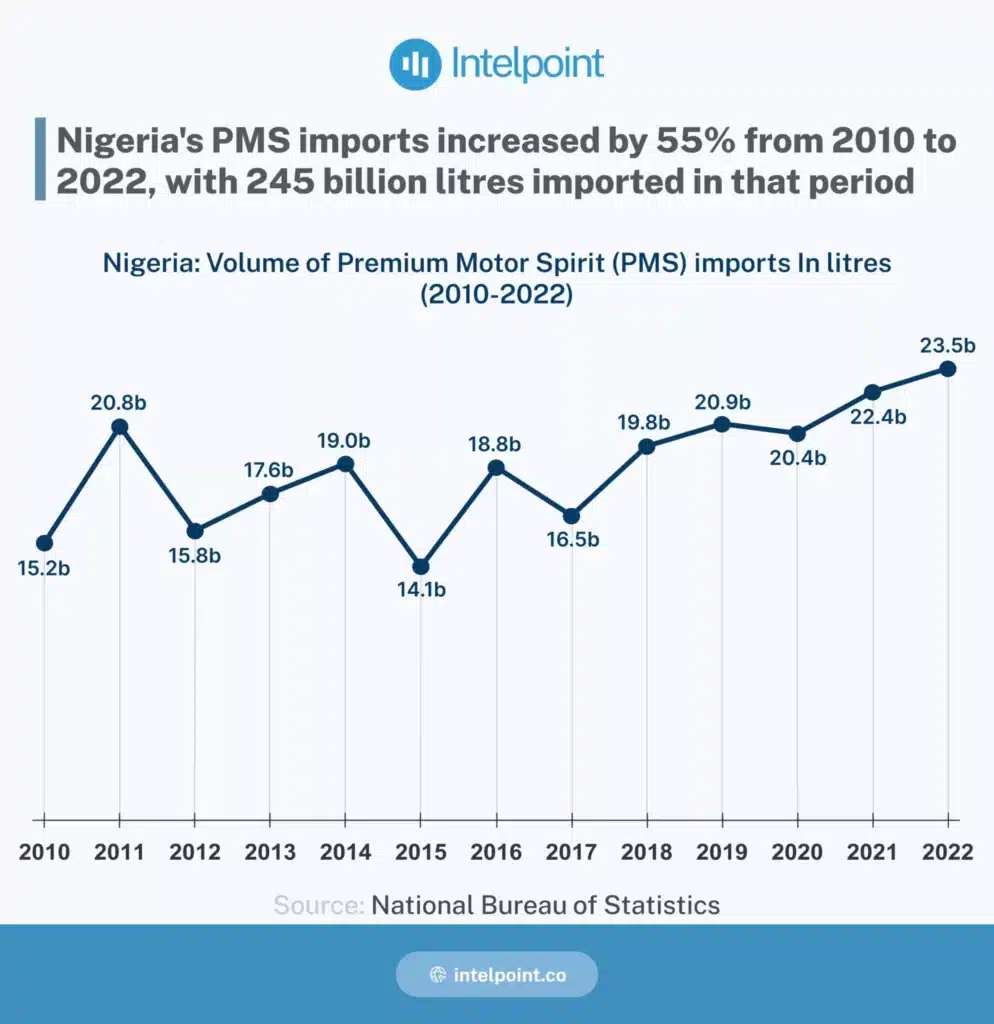

Nigeria, an oil-rich nation and Africa’s leading crude oil producer, has long depended on petrol imports to meet its energy needs.

While crude oil remains the country’s primary export, interestingly, its major imported product is petrol.

This imbalance has left the nation in a difficult economic position.

Over 40% of Nigeria’s foreign earnings from crude oil sales are ultimately spent on petrol imports, leaving the country financially strained.

The heavy dependence on petrol imports is primarily due to the non-functional state-owned refineries, which have remained moribund for over three decades despite billions of dollars spent on their rehabilitation.

In November, the state-owned oil company NNPC claimed to have revived two of its refineries in Warri and Port Harcourt, both in the Niger Delta region.

However, their combined capacity does not exceed 200,000 barrels per day (bpd).

This rehabilitation, however, is far from promising as NNPC and other major marketers still continue to import petrol in significant volumes.

Dangote enters the market

The post-subsidy pricing mechanism has also created room for the sole privately owned refinery in the country—Dangote Refinery—which began processing petrol last September.

With a capacity of 650,000 barrels per day, Dangote has slashed petrol prices five times in the last four months— a move many attribute to its attempt to penetrate and dominate the downstream market.

Despite being the only operational petrol-processing refinery in the country, Dangote still struggles for patronage.

The company’s CEO, Aliko Dangote, has blamed this on sabotage by petrol importers.

Last year, the company took four major importers and a regulatory body to court over licensing issues for importing petrol into the country.

The case is still ongoing.

Despite major price cuts and persistent public campaigns, the $20 billion refinery has only managed to secure three petrol vendors—MRS Oil, Ardova Plc (AP), and Heyden—as partners in the country, while others continue to opt for imported products.

The momentum, however, is still building.

Last week, Dangote announced yet another price cut for its partners, bringing the retail price down from N945 to N860 per litre.

In an unexpected move, NNPC also slashed its prices, setting the retail price at N860 per litre in Lagos and N865 in Abuja. Many believe this is a strategic effort to compete with Dangote.

Post-Subsidy pricing mechanism

Before the removal of the petrol subsidy, prices were largely uniform across the country, with only slight variations due to logistics, transportation, and other local economic factors.

This price stability created a sense of predictability for consumers, buyers, and middlemen, keeping product rates steady.

Price adjustments were typically announced by the federal government or NNPC, which played a dual role as both a market player and regulator for the downstream sector.

However, the passage of the Petroleum Industry Act (PIA) in August 2021 changed this dynamic.

NNPC was stripped of its regulatory powers and became just another competitor in the sector.

The PIA also paved the way for the complete phasing out of the fuel subsidy, which President Bola Tinubu announced in May 2023.

Unlike the subsidy era, where prices were controlled by the government, the post-subsidy period is expected to be guided by market forces such as production costs, global crude oil prices, logistics, and transportation.

According to Ayodele Oni, an energy law expert at Bloomfield, the PIA does not explicitly address market share issues, leaving pricing mechanisms to individual companies and prevailing market realities.

“Currently, Dangote’s price reduction does not violate the provisions of the PIA; it only encourages competition in the downstream market,” Oni added.

A brewing rivalry

NNPC has yet to fully explain the rationale behind its price cuts, aside from brief comments from its officials suggesting the move is intended to provide relief to consumers.

Meanwhile, the oil company had previously accused Dangote of attempting to establish a monopoly.

On its part, Dangote has accused NNPC of trying to undermine its business by failing to supply the obligated amount of crude oil to its refinery.

With both companies using price cuts as a strategic weapon, the tension between them is likely to persist.

The Cost of price cuts

Meanwhile, this price war does not come without its costs—for both Dangote and NNPC.

NNPC has not disclosed how it is managing the financial impact of its price reductions.

However, analysts suggest that the company may be leveraging cheaper petrol imports from existing stock while offsetting losses through its broader supply chain and other business ventures.

Dangote, however, has been more transparent about the financial strain of its pricing strategy.

Following its latest price reduction, the company revealed it had incurred a replacement cost of over N16 billion ($10.6 million) to compensate partners who had purchased petrol at higher prices.

Dangote announced it would refund N65 per litre on over 200,000 metric tonnes of petrol purchased at the old rate of N890 per litre before the price drop to N825 per litre.

The question remains: can Dangote continue to sustain such losses if it keeps cutting prices dramatically?

For NNPC, analysts believe its diversified operations and extensive supply chain could help mitigate costs more effectively.

Benefits for consumer and economic growth

The recent downward shift in petrol pricing may seem costly for producers and marketers, but for most Nigerians, it comes as a welcome relief.

For many consumers, the post-subsidy era was expected to bring temporary pain but long-term benefits.

There was hope that market competition would drive down prices, ultimately easing the financial burden on ordinary Nigerians.

That optimism, however, didn’t materialize right away—though the current price trend suggests a gradual decline.

As James Akwaji, an energy professional, put it:

“I see the Dangote refinery price slashes as a way of driving economic growth and competition rather than edging toward a monopoly.

“His actions have forced other marketers to adjust their prices, benefiting consumers.”

Any reduction in petrol prices is a win for most consumers who rely on the fuel to power their homes, generators, and businesses—especially in the face of an unstable power supply and an unreliable national grid.

When it comes to transportation, most vehicle owners in the country still depend on petrol-powered cars, meaning lower fuel costs could translate to reduced transportation expenses for both car owners and commuters.

Although the government has pushed for the adoption of compressed natural gas (CNG) following the removal of fuel subsidies, the shift has been slow.

Petrol still remains the primary fuel for the vast majority of vehicles in the country.