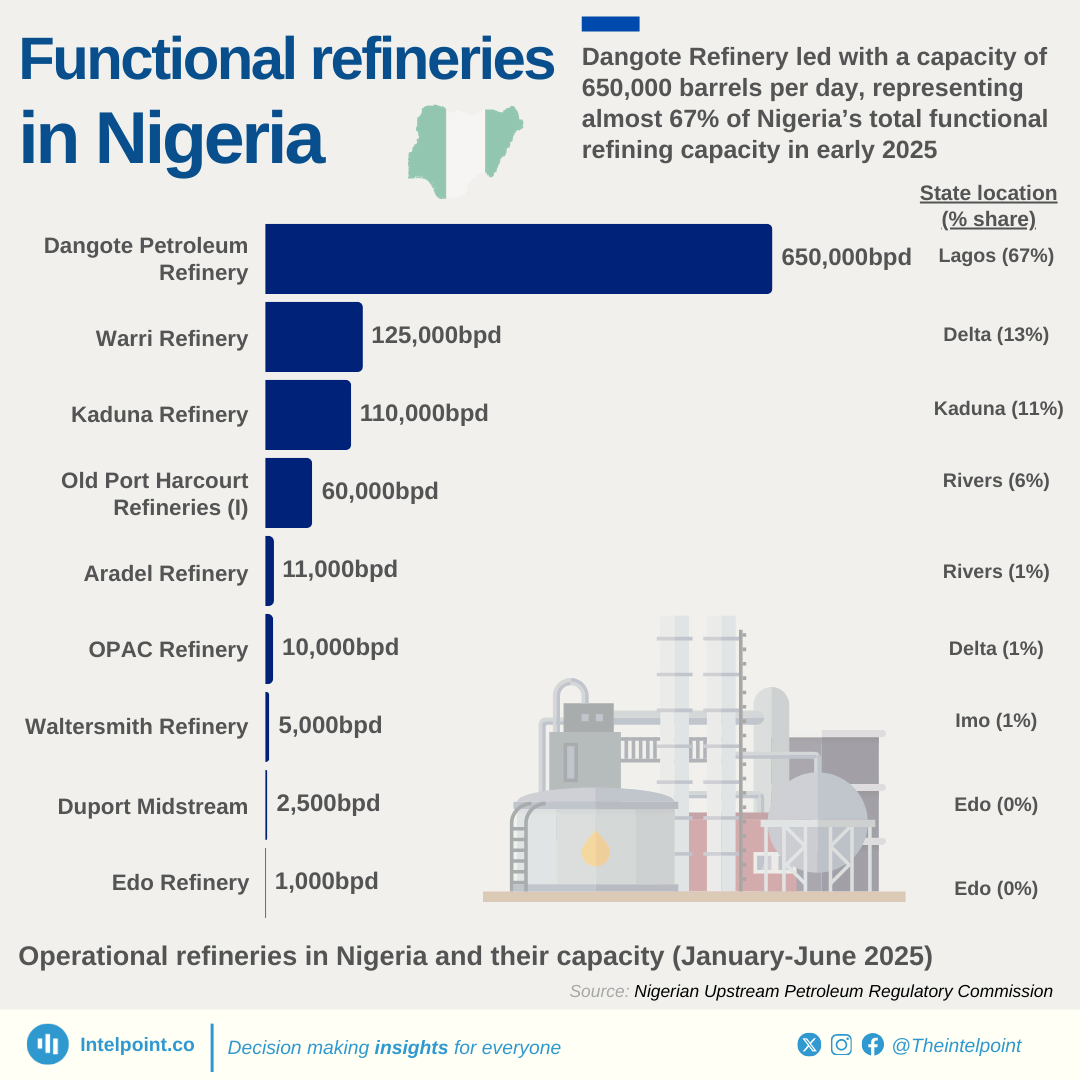

The 650,000 barrels-per-day (bpd) Dangote Refinery in Lagos is a privately driven mega-project designed to meet Nigeria’s entire refined petroleum needs—a development already reshaping the country’s fuel market.

Government data confirms the shift.

According to the Central Bank of Nigeria (CBN), petroleum import expenditure fell by 23.2% to $14.06 billion in 2024, delivering significant foreign exchange savings.

Much of this drop is credited to the Dangote Refinery, which has sharply reduced Nigeria’s reliance on imported petrol.

Before its entry, the country spent about $400 million every month on petrol imports, an irony for Africa’s top oil producer.

Now, that scenario is changing fast. Analysis shows the refinery boosted Nigeria’s refining capacity by over 600% in the past year.

In March 2025 alone, the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) reported that Dangote accounted for 41% of total petrol consumed nationwide.

That same month, Nigeria’s daily petrol demand averaged 49.8 million litres, with Dangote emerging as the country’s single largest supplier.

Yet, the company is not satisfied with just refining.

It is pushing deeper into fuel distribution—a strategy some insiders describe as a “multi-million-dollar shakedown” of the downstream market.

Alongside plans to upgrade its Lagos refinery to 700,000 bpd, Dangote has rolled out a fleet of trucks worth $470 million, aiming to dominate not just refining but also transportation and delivery.

Analysts say this bold expansion could unsettle traditional fuel marketers who have long controlled distribution channels. Some describe it as “perhaps the most daring marketing strategy by any private sector operator in Nigeria in recent years.”

What Dangote CNG truck disruption entails

In mid-June 2025, the management of the Dangote refinery revealed it would begin the direct supply of petrol and diesel across the country by August 15.

The market strategy is targeted at eliminating logistics costs for a broad spectrum of customers including filling stations, manufacturers, airlines and telecom companies.

The registration and Know Your Customer (KYC) processes for interested off-takers in these sectors were concluded on the day this programme kicked into force.

The refinery spokesman, Anthony Chiejina, said up to 4,000 new compressed natural gas (CNG)-powered trucks, valued at $470 million (N720 billion), had been acquired to enhance the distribution of fuel to these concerns.

An oil market analyst described the move as “the Uber moment for the Nigerian fuel sector.”

“Players in these key sectors and others can purchase directly from the Dangote Petroleum Refinery,” Chiejina said.

Even before anyone could ask who would foot the transport bill, the refinery says these petroleum products will be delivered cost-free.

The average logistics cost is estimated at N45 per litre, amounting to over N1.07 trillion annually.

Analysts say this is a huge price only companies with deep pockets like Dangote Group can afford.

Chinnan Maclean-Dikwal, vice chairman of the African Energy Council ideate a scenario where Dangote can control his logistics and eliminate at least 3-4 layers of middlemen, who add no value, but costs.

“Think about this –if each layer of middleman adds just N20 per litre to the cost, Dangote’s integrated system could theoretically shave off N60-N80 per litre from the final price.

“This saving, if passed on to consumers, would directly lower transport costs, food prices, and the overall cost of living for millions. And so I posit that, this benefit trounces that to be gained by a few tens of thousands of middlemen.”

Jide Pratt, the country manager at TradeGrid, a digital oil and gas trading company, calls this the “catch” in the integrated supply chain model being coveted by Dangote.

“Ideally, when products get to the retail stations, it’s a combination of costs plus transportation. ‘

These are the two factors that make it get to the underground tank before you add what is called the dealer’s commission, which means the person who runs the retail station gets a margin, and then you carve what is called the pump price.”

But this is not the first time the company will be footing the cost of fuel supplies to its dedicated customers.

Last year, it wrote off about the same amount in logistics costs for its fuel buyers.

Not only that, Dangote has in the new scheme offered buyers of its fuel products a 50% bank-backed credit facility for two weeks, particularly for those lifting at least 500,000 litres per transaction.

Maclean-Dikwal took a rather analytical view of a much larger picture of how Dangote’s move is not a mere hostile takeover, but a necessary, albeit painful, market correction that promises substantial benefits for the average Nigerian citizen.

“So from my viewpoint, I think Nigeria’s real, albeit unofficial, monopoly is the fragmented cartel of importers, depot owners, and transporters who have profited from decades of inefficiency, government subsidies, and price arbitrage.

“This legacy system created artificial scarcity, fostered smuggling and diversion, and passed exorbitant costs onto consumers.

“So I posit that Dangote’s refinery and logistics network are not creating a monopoly; rather it is disrupting an existing, inefficient one. His 4,000 trucks, while a formidable fleet, will still operate in a market with tens of thousands of other independent trucks.

“His goal isn’t to own every truck but to create a highly efficient, low-cost transportation system to get his own product to market, forcing competitors to become more efficient or to exit the market. Tough, but that’s how business works,” he said.

Market implications on legacy middlemen

The market disruption is expected to bring efficiency to the supply chain.

Etulan Adu, an oil and gas production engineer at Eni said the scheme, though disruptive in nature, would benefit consumers at the pump.

“The reality is that boycotting major marketers and having direct access to …filling stations is a threat to existing distribution, even though their operations haven’t [fully] benefitted the masses over the years”, Adu said.

Despite its potential to make fuel products available and affordable, the development does not still sit right with trade associations.

Some trade unions have opposed the move, raising concerns of being kicked out of business.

More so, some fuel importers whose activities the refinery has already disrupted in recent months fear it might erode their control on the home front.

“In one fell swoop, he is trying to wipe us out,” said Billy Gillis Harris, head of Petroleum Products Retail Outlet Owners Association of Nigeria (PETROAN).

PETROAN, a union of over 6,700 members, argues the entry strategy could endanger the livelihoods of thousands of its drivers and traders who currently supply products to telecom companies, filling stations and manufacturers

“This unprecedented scale of distribution, if left unchecked, could significantly undermine the independence and survival of thousands of small and medium-scale operators across the country,” said Tekena Ikpaki, the chapter chairman of the union for Rivers state.

Ikpaki cautioned that such control also destabilises the livelihoods of over 10,000 independent marketers across the country.

However, the Independent Petroleum Marketers Association of Nigeria (IPMAN) has commended the development, saying it is a timely resolution to longstanding challenges in the downstream sector.

“Our pipelines have been non-functional for years, yet nothing has been done to revive the infrastructure linking the country’s 21 depots. We’ve had to rely on expensive transport from coastal depots,” said Chinedu Ukadike, IPMAN’s National Publicity Secretary.

“Dangote’s intervention lifts a huge burden off the shoulders of independent marketers.”

How will middlemen survive?

Likewise, the Natural Oil and Gas Suppliers Association of Nigeria (NOGASA) has warned that the refinery’s plan to bypass existing distribution channels could jeopardise existing supply networks.

But its National President, Bennett Korie, however said the concerns were raised in a recent meeting with the Dangote refinery in Abuja.

He said both sides have agreed to allow members to lift products as bulk buyers before onward distribution to end users.

“I want to say that Dangote heeded our plea by agreeing with us that they will be sending these products to the bulk buyers, who are the suppliers. Based on that, we won’t have issues again,” Korie said.

“What we were saying ab initio was the issue of the supply chain in which we have invested so much. We requested that the supply chain be given to us in distribution, which I think Dangote has also complied with, since he is not going to supply directly to end users. We want to appreciate him for that,” he said.

But how effective or durable this partnership will be remains to be seen.

At first, it is speculated that one of the reasons why Dangote decided to enter the distribution market was that it saw huge gaps that traditional marketers couldn’t fill.

Ssanamo Tanzamado, CEO at Chrome Tourmaline Ltd, a Nigeria-based export processing company, likens the entry of Dangote into the downstream line to “the catfish effect”.

“The presence of a strong competitor or challenging element like Dangote will stimulate progress and innovation in a previously stagnant sector.”

“In the same way that fishermen add catfish to a tank of sardines to keep the sardines active during transport, Dangote’s competition can drive middlemen to greater performance, resilience and adaptability.”

Chidi Emele, a Logistics Safety Expert at SIFAX Group said “The use of poorly managed business models by traditional marketers and their failure to build a sustainable downstream distribution network for products provided Dangote the leeway for the shakedown.”

Maclean-Dikwal noted that the Dangote model will stem illegal cases of product adulteration and abuse that often result in safety risks in the country

“Dangote’s end-to-end control via the use of sealed and GPS-tracked trucks will ensure product quality and integrity from the refinery gate to the depot. For the average Nigerian consumer, this means cleaner fuel, which is safe (with little risk of explosion) and also translates to longer engine life for cars and generators, reducing expensive maintenance costs.”

However, with the status quo now being challenged by a major player, the traditional middlemen might need to explore other means to survive in the market.

Some could also “green” their supply chains by diversifying into the use of CNG trucks, perhaps even further to the domestic gas distribution business. Slow-selling stations could be converted into gas outlets to sustain cash flows.

Also, they should slow down on building new tank farms or purchasing non-CNG trucks, as these investments are gradually winding down. The focus now should be on optimising current assets and how to innovate.

Progress so far and potential economic impact

The rollout of the scheme is currently witnessing a delay as many of the ordered trucks are yet to arrive from China because of a logistics crisis.

But as of August 18, three days after the scheduled rollout, only 450 trucks were said to have arrived Nigeria from China, with 150 more expected in the following week.

This means that less than 20% of the acquired 4,000 trucks have been delivered.

“The business disruption that a few thousand independent marketers will suffer, pales in comparison to the tangible, life-changing benefits that ordinary Nigerian citizens will enjoy,” Maclean-Dikwal said.

Despite this drawback, the nationwide scheme, when fully implemented, is expected to save Nigerians over N1.7 trillion annually, reducing the energy cost of over 42 million Micro, Small and Medium Enterprises (MSMEs).

It is also expected to help reduce pump prices and inflation, even though some people still doubt this.

Notably, the $470 million investment includes the establishment of nationwide CNG ‘mother and daughter’ stations, among other infrastructure, to implement the free distribution initiative. Many dormant filling stations are also expected to be revived with products.

Up to 15,000 direct jobs are projected to be created across the logistics chain, from CNG truck drivers to station managers, and attendants at the CNG stations.

This perfectly aligns with the Presidential Compressed Natural Gas Initiative (PCNGI), further expanding the adoption of gas as a sustainable and clean transport fuel in Nigeria.

Furthermore, the government will earn some customs duties on the imports of these trucks, which could amount to billions of Naira, though it can be argued that this will be offset by the huge billions of Naira in capital flight that goes into buying them.

Of course, the successful implementation of the scheme will help fix existing fuel supply challenges faced by key sectors like manufacturing, which will boost output and drive economic productivity.

Market outlook

The direct-entry approach currently being implemented by the Dangote Refinery marks a consequential shift in Nigeria’s downstream oil sector.

While the move may be legal under provisions of the Petroleum Industry Act (PIA), its ripple effects cannot be ignored.

Many middlemen in the sector stand to lose out, raising questions about monopoly, regulatory fairness, and the potential impacts on consumers.

Pratt notes that “The Dangote model intends to exclusively control the supply chain from the refinery to the underground tank.”

On the other hand, Maclean-Dikwal argues that the model will create “a reliable supply chain [where] fuel stations will have consistent stock.”

He adds: “The average Nigerian will no longer have to spend hours or even days in queues. This reclaimed time can be used for work, family, and other productive activities, boosting the nation’s GDP in a very real way.”

Still, some industry voices speculate that the logistics costs currently absorbed by Dangote may eventually be passed down to the consumer, potentially pushing pump prices higher.

Overall, the direct-market-entry model is disruptive. While it promises reduced logistics costs and potentially more affordable fuel at the pump, it simultaneously threatens the livelihoods of traditional middlemen.

“But dialogue and cooperation with market regulators is essential to ensure fair play,” Adu cautioned.

That balance is critical for long-term market stability. If Dangote secures unchecked dominance, middlemen and parallel investors risk being edged out.

Conversely, if regulators impose excessive restrictions on the mega refinery, it could send an equally damaging signal—that innovation is unwelcome in Nigeria’s oil sector.

But whether this disruption spells opportunity or trouble depends on how quickly marketers or middlemen can adapt.

As Dangote cements its role at the heart of Nigeria’s fuel market, the downstream sector may never look the same again.