The federal government Road Infrastructure Tax Credit Scheme (RITCS) is a government program that lets companies fund road projects in exchange for tax relief.

The scheme allows companies to finance road construction or repairs and receive equivalent deductions from their tax obligations.

The Nigerian National Petroleum Company Limited (NNPC) was a key participant in the programme but is now stepping away after spending more than N822.3 billion ($513.94 million) on it in 16 months.

This exit leaves the federal government with a funding gap of N3 trillion ($1.875 billion) to complete road projects NNPC had been financing.

The move is part of the company’s shift to focus strictly on its core business and improve profitability.

What is the road tax credit scheme?

The RITCS was introduced in 2019 during the administration of the late former President Muhammadu Buhari through Executive Order 007.

It allowed private companies to finance the construction or rehabilitation of critical road infrastructure and get equivalent tax credits in return.

These credits were used to reduce future tax liabilities, meaning companies could invest in roads instead of paying the same amount in taxes. The idea was to accelerate road development without depending fully on budget allocations.

Under the programme, companies worked with the Federal Inland Revenue Service (FIRS) and the Federal Ministry of Works to identify and fund approved projects.

The cost of these projects would then be deducted from the company’s future tax obligations.

NNPC’s role and spending

NNPC was one of the largest participants in the RITCS. In late 2021, the company launched Phase I of its participation, pledging N621.24 billion ($388.28 billion) for the reconstruction of 21 strategic roads covering about 1,804.6 kilometres across all six geopolitical zones.

The roads included the Ilorin Jebba, Mokwa/Bokani Junction Road in Kwara and Niger States, the Suleja Minna Road, and parts of the Bida Lambata Road.

The Lagos Badagry Expressway was also a major focus, with rehabilitation and partial expansion works aimed at improving trade routes in the South west.

In January 2023, NNPC expanded its involvement with Phase II.

This phase involved a N1.9 trillion ($1.188 billion) investment to reconstruct 44 federal roads covering roughly 4,554 kilometres nationwide.

Among these were the East West Road, the Port Harcourt Onne Junction upgrade, and the Eket bypass in the South south.

In the North east, projects included the Yola Mubi Maiduguri corridor and the Numan Jalingo, Bali Serti Gashaka Gembu route in Taraba State.

According to the Federation Account Allocation Committee (FAAC) Post Mortem Sub Committee report, NNPC’s contributions were deducted from its Companies Income Tax (CIT) obligations.

These deductions were processed through FIRS and channelled directly to the approved road projects.

The report showed that up to December 2024, NNPC made monthly dollar payments, with its last contribution of $52.5 million paid that month.

By the end of the year, its cumulative dollar payments had reached $577 million

From January 2025, the deductions switched to naira denominated payments. N151.27 billion (94.54 million) was recorded in January 2025 and N671.04 billion ($419.40 million) in April 2025, bringing the naira total to N822.3 billion ($513.94 million) within the 16 month period covered.

The FAAC report noted that these figures excluded NNPC’s contributions before 2024. This means the company’s total historical spending on the scheme is likely far higher.

Why NNPC decided to exit

NNPC’s withdrawal from the scheme is linked to changes in its operational structure and goals.

The company said it has adopted a new focus on profitability and efficiency, moving away from the off budget spending obligations that marked its operations when it was fully government controlled.

This shift follows the enactment of the Petroleum Industry Act (PIA), which turned NNPC into a fully commercial entity.

The law altered the company’s mandate, making it operate like a profit driven business rather than a government agency.

With this change, NNPC has been cutting back on non core expenditure.

The RITCS, although important for infrastructure, was not directly tied to its main oil and gas business.

By exiting the scheme, the company is freeing up resources for upstream oil and gas investments, energy transition projects, and other ventures that align with its primary operations.

NNPC officials have stated that focusing on these areas will strengthen the company’s long term financial health.

The FAAC report confirmed that NNPC’s exit means these road projects will now rely on alternative funding sources.

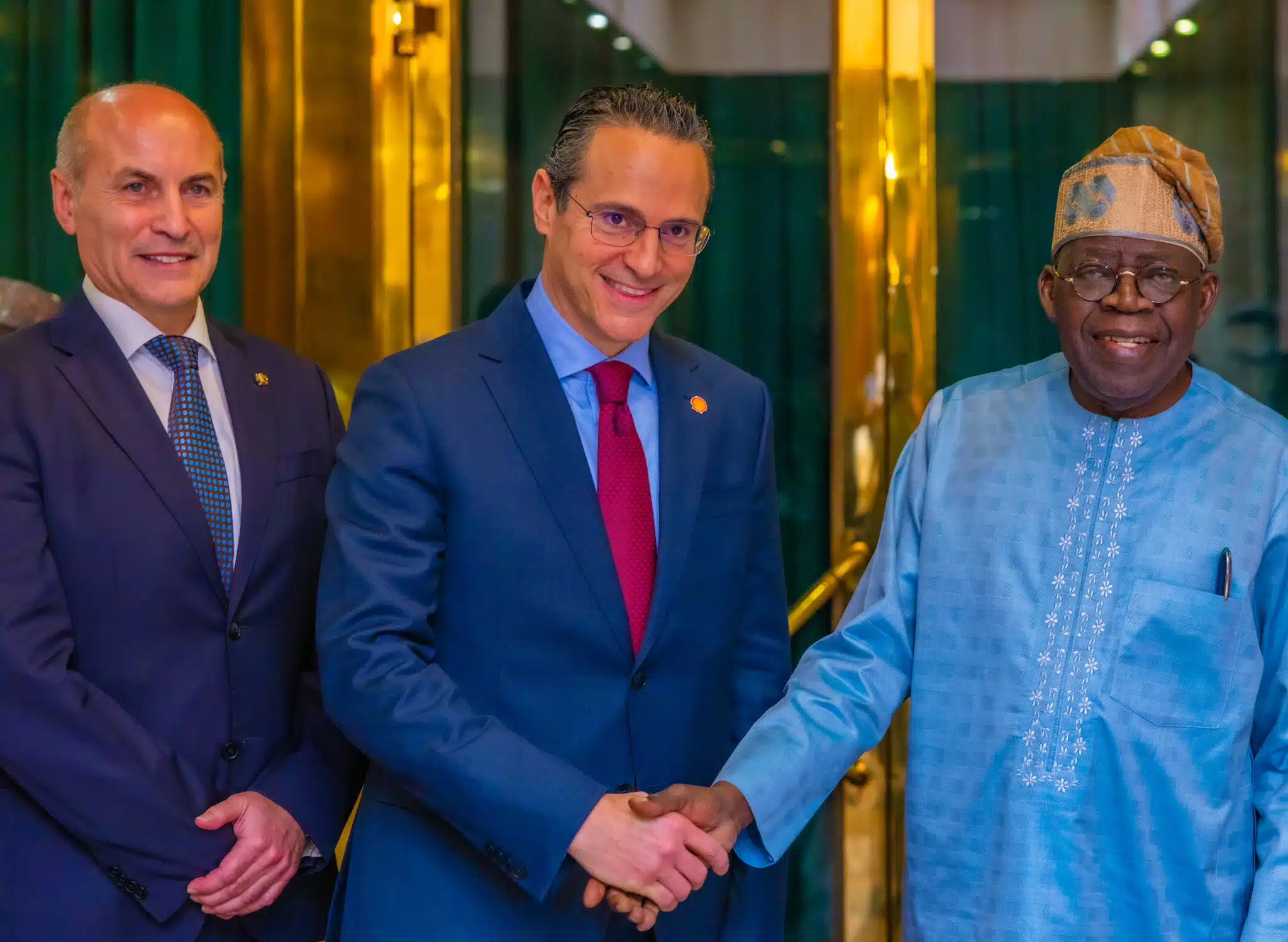

The Minister of Works David Umahi said President Bola Tinubu had directed the ministry to compile a list of affected projects for review under a Public Private Partnership (PPP) model.

Impact on road projects

Meanwhile, the Nigerian government now faces the challenge of finding N3 trillion to finish the roads NNPC was funding.

Many of these roads are critical national highways that connect major cities and support trade between regions.

Umahi explained that the government is considering other funding approaches to ensure the projects are not abandoned.

“The federal government requires N3 trillion to complete road projects awarded under the NNPC tax credit scheme,” he said during a recent briefing.

These projects include highways such as the Lagos Badagry Expressway, the East West Road, and the Nembe Brass Road in Bayelsa State.

Several routes in the North central and North east are also on the list.

Criticism of the scheme

While the RITCS was praised for attracting private investment into road construction, it has faced criticism from members of the public.

Concerns have been raised about transparency in selecting which projects to fund.

Questions have also been asked about whether the costs of some projects were inflated compared to market rates.

These concerns come at a time when Nigeria is struggling with high debt servicing costs and foreign exchange pressures.

The FAAC report also mentioned that the Ministry of Works had yet to provide detailed information about agencies benefitting from the scheme.

The Ad hoc Committee reviewing the deductions had written to both FIRS and the Ministry of Works for clarification.

The Ministry of Finance submitted its own report on 16 July 2025 for review.

As at the FAAC sub committee’s last meeting, the Works Ministry had not responded.

What happens next

NNPC’s withdrawal marks a significant change in how the RITCS will operate going forward. The company had been a major player in funding road infrastructure under the scheme.

With the government now exploring other models such as PPPs, the future of many ongoing road projects will depend on how quickly alternative investors or partners can be brought in.

Delays in securing funding could stall projects and worsen road conditions in affected areas.

In sum, the Road Infrastructure Tax Credit Scheme remains a key policy tool for road development in Nigeria.

However, the exit of its biggest corporate contributor has exposed funding gaps and raised fresh questions about how sustainable the programme will be without strong private sector backing.