As far as Africa’s oil and gas landscape is concerned, 2024 was the year of anticipation for many hydrocarbon-rich nations, while 2025 became the year of decisions.

This year, across the continent, long‑awaited Final Investment Decisions (FIDs) finally moved from boardrooms to reality, reshaping Africa’s energy narrative once again.

These are not just routine approvals — they are bold commitments that signal confidence in Africa’s reserves, infrastructure, and future role in global energy markets.

From deepwater projects off Nigeria’s coast to LNG expansions in Mozambique and frontier developments in Namibia, each FID carries weight far beyond its immediate economics.

They help unlock billions in capital, promise thousands of jobs, and position African nations to capture new demand in a world balancing energy security with the energy transition.

What makes 2025 stand out is not just the scale of these investments, but the timing. With global capital becoming more selective and climate pressures intensifying, we can both agree that every greenlighted project tells a story of how Africa continues to emerge.

The continent has not only shown resilience in its quest to overcome energy poverty, but its governments have continued to bargain strategically with foreign investors who need Africa’s oil and gas to keep the engines of their economies running.

Key FIDs in Africa’s oil industry this year

2025 has been a turning point for Africa’s oil industry, marked by a wave of FIDs that unlocked billions of dollars in new projects.

A Final Investment Decision (FID) is the point at which an oil and gas company formally commits to proceed with a major project — such as developing a new oil field, building an LNG plant, or expanding infrastructure.

It often comes after years of exploration, feasibility studies, engineering design, and negotiations.

FIDs represent confidence in the project’s economics, market demand, and regulatory environment.

Once an FID is taken, the company allocates capital, signs contracts, and begins construction or development.

Country by country, we explore the most notable FIDs of the year — the projects that didn’t just define the 12‑month period, but set the trajectory for Africa’s oil and gas industry for the next decade.

Mozambique

It has been a remarkable year for Mozambique’s petroleum industry. The country saw a major FID for Eni’s Coral North LNG project, a $7.2 billion Floating LNG development in Area 4 of the Rovuma Basin, aiming for 2028 production.

At the same time, the broader Mozambique LNG project, previously halted, showed strong signs of restart, with force majeure lifted and financing secured by TotalEnergies. The US Export‑Import Bank approved a historic $4.7 billion loan to get the project started, potentially positioning Mozambique for significant global LNG output before the end of the decade.

Progress recorded on the TotalEnergies‑led project also prompted ExxonMobil to lift its hiatus on the $30 billion Rovuma LNG venture, which is now being prepped for an FID next year. The project will leverage Area 4 resources with onshore trains.

Nigeria

Africa’s most populous nation became the epicenter of FID activity in 2025, with the country’s upstream regulator NUPRC approving 28 field development plans (FDPs) and attracting $18.2 billion in capital expenditure.

In early May, ExxonMobil told the Nigerian upstream regulator NUPRC that it plans to commit $1.5 billion between Q2 2025 and 2027 into the exploration and development of the Usan deepwater asset.

Moreover, Nigeria’s state‑owned energy company NNPC said in June that it would take four FIDs by Q4 of 2025 across an array of projects including the Ntokon discovery, Ofon, and the delayed Brass fertilizer and petrochemicals project.

The company is expected to take these actions this December, which concludes the fourth quarter of this year, alongside TotalEnergies’ $750 million shallow‑water gas project, which is also billed for an FID before the year ends.

In the same vein, Nigeria’s Dangote Petroleum and Petrochemicals announced plans to more than double the capacity of its refinery plant from 650,000 bpd to 1.4 million bpd over the next three years.

After a couple of bad years when upstream investments almost came to zero, Nigeria has seen increased investment in recent years. Just last year, the country secured three out of the four FIDs that came to Africa, representing over $5.5 billion in capital inflows.

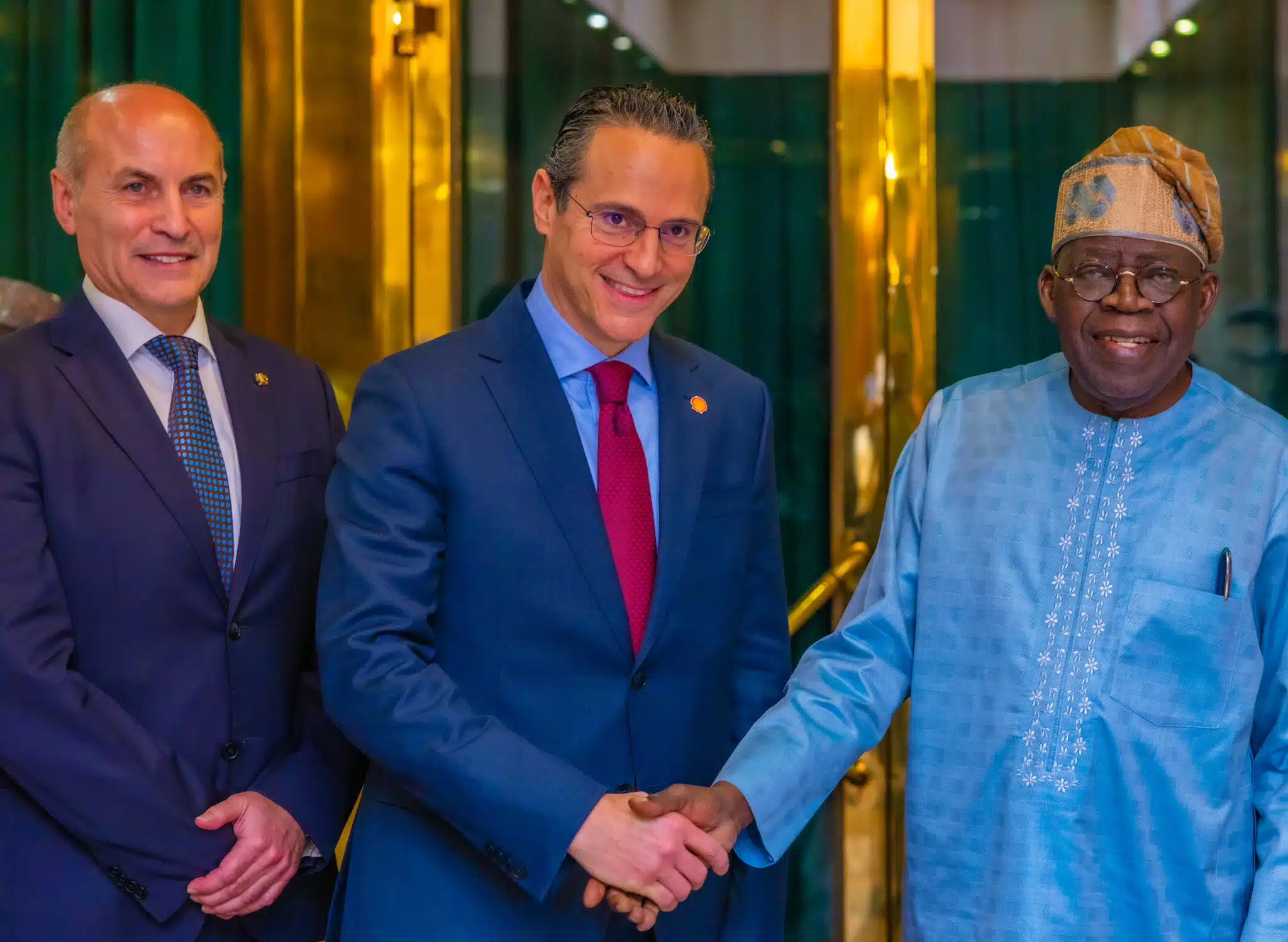

“We moved from gridlock to greenlight, and investors responded,” said Olu Verheijen, Special Adviser on Energy to President Bola Tinubu, at the 2025 Africa CEO Forum in Abidjan in May.

“In under a year, Nigeria unlocked over $8 billion in deepwater oil and gas Final Investment Decisions through decisive presidential action,” Verheijen said.

Namibia

While no major FIDs were officially taken in Namibia’s oil and gas sector during 2025, the desert southern African country continued to witness momentum in the Orange Basin. 2025 was widely described as a pre‑FID year, with companies preparing groundwork for decisions expected in 2026.

Despite Shell’s $400 million writedown setbacks, discoveries by Galp (Mopane), Rhino Resources (Capricornus), and TotalEnergies’ appraisal of its massive Venus find continue to keep the frontier active.

The French oil major looks forward to taking an FID for Venus in late 2026, potentially leaving behind its interests in South Africa after being slapped with several court injunctions against exploration.

Despite controlling a larger share of the prolific Orange Basin, we have seen this year how opposition from environmental groups and tighter regulations in South Africa’s upstream sector continue to hamper hydrocarbon development.

South Africa plans to fully transition to zero carbon emissions by 2040, with many questioning its feasibility. However, TotalEnergies has hinted that it might halt oil and gas exploration in the country altogether if the opposition becomes unbearable.