After what has been a troubling few years for one of Africa’s biggest gas producers, Egypt is steadily roaring back to life. And it is not just about the numbers, even reality checks on the ground have shown that things have eased.

Behind the billions of dollars in new investments and infrastructure upgrades are a cast of powerful players reshaping the country’s energy future.

From global giants like Shell and BP to rising regional firms and state-backed operators, the race to unlock Egypt’s gas potential has continued drawing serious attention.

After years of declining output and rising import bills, Egypt is now drilling deeper, building smarter, and negotiating harder.

So who’s really driving the comeback?

And which projects are setting the pace for Egypt’s next energy boom?

Let’s dive into the faces, deals, and ambitions fueling this high-stakes transformation.

Egypt’s gas comeback: From decline to recovery

After a 40% drop in gas output since 2021, Egypt is staging a strong recovery that will help it reduce LNG imports and boost domestic supply.

Gas output began recovering in mid-2025, increasing by over 200 million cubic feet per day (mmcf/d).

This rebound has helped reduce the country’s fuel import bill by $3.6 billion and settle $1 billion in arrears to international partners.

In the one year period up to May 2025, Egypt had also drilled 75 wells across the country which resulted in 40 new oil and gas discoveries, according to the government.

The government, through EGAS (Egyptian Natural Gas Holding Company), is implementing seven new gas field projects and placing 24 wells into production for FY 2025/26.

Who are the big investors behind the billions?

A number of big foreign players are partnering with indigenous and state-owned companies to invest massively in key assets in Egypt that are expected to significantly boost domestic gas supply and support the government’s gas ambitions.

These include:

Eni: The Italian energy giant is Egypt’s largest hydrocarbon producer and contributes about 40% of its natural gas output.

It’s been operating in Egypt since the mid-1950s, controlling some of the country’s major gas fields including Zohr (Egypt’s largest), Nooros and Baltim South West, Meleiha and the Temsah concession.

The company has resumed drilling at the Zohr field where production has fallen from a peak of 2.7 Bcf in 2019 to 1.9 Bcf in 2024. Zohr alone contributes over 23% of Egypt’s total daily gas production.

Eni has committed up to $8 billion to boost output at key gas fields (including the giant Zohr field) before 2030.

BP: The British energy giant has significant gas assets in offshore Egypt. As part of an exploration campaign this year, the company made two discoveries at the Fayoum-5 and El King-2 wells.

Additionally, it has recently signed a new offshore gas exploration agreement with EGAS to drill five wells in the Mediterranean where the oil company already has existing concessions.

The new campaign – which includes sidetrack, development and exploration wells – will be carried out in Q1 2026 and has been awarded to New York-based drilling contractor Valaris for a total of $140 million.

BP has set a new target to produce between 2.3 and 2.5 million barrels of oil equivalent per day by 2030.

Shell: Shell has investment in Egypt’s gas sector and has recently taken moves in the country that shows it will be there for long.

Through its affiliate BG International Limited, Shell is spearheading several key projects in the Mediterranean Sea aimed at enhancing Egypt’s natural gas production and infrastructure.

In July 2025, Shell and its partner KUFPEC Egypt Limited made a final investment decision to develop the Mina West gas discovery in Egypt’s Mediterranean waters.

The company is also investing in the North Marakia block, a strategic offshore asset that aligns with Egypt’s goal of becoming a regional gas hub. The block is part of Shell’s broader plan to tap into Egypt’s underexplored offshore reserves.

Strategic projects and infrastructure expansion

Egypt has witnessed significant expansion in its gas sector with key positive developments including:

Significant gains in natural gas reserves: Egypt has witnessed interest from foreign operators, amid significant growth in natural gas reserves. This year alone, Egypt’s gas reserves have grown by over 36 billion cubic feet (bcf) in 2025 alone.

Dana Gas added 21.3 bcf of proved and probable reserves in the Nile Delta, while Badr El Din (BED) Petroleum discovered a new gas field in the Western Desert’s Badr-15 concession that has also contributed 15 bcf.

Majors like ExxonMobil, Eni and BP have planned to drill several exploration and production wells across key gas concessions in the country’s Mediterranean and Nile Delta regions over the coming months.

Egypt currently has about 78 trillion cubic feet (tcf) in total proven gas reserves, behind countries like Nigeria and Algeria, but ahead of many others in the Eastern Mediterranean region.

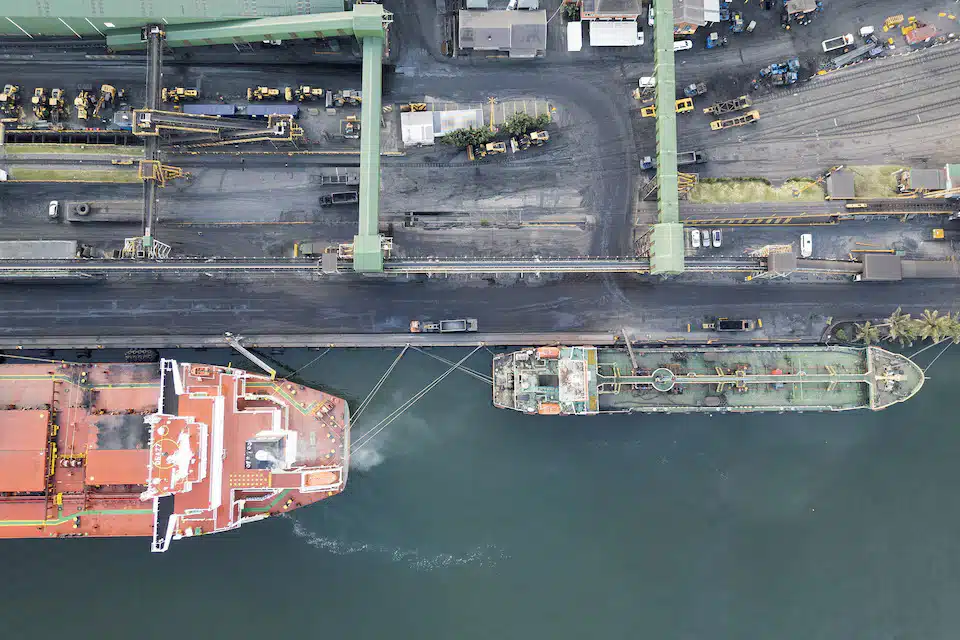

Upgrades to the Idku LNG plant: The Idku LNG plant, located about 50 km east of Alexandria, Egypt, is undergoing strategic upgrades aimed at increasing its operational efficiency and export capacity.

Originally commissioned in 2005 with two liquefaction trains and a capacity of 7.2 million tonnes per annum (Mtpa), the facility is being optimised to handle increased output. This includes maintenance and modernisation of existing infrastructure.

The Idku LNG project is a joint venture involving: Shell, Petronas, Engie and the Egyptian government (via both EGAS and EGPC)

The Nitzana gas pipeline: This is a proposed 65-kilometre pipeline that will run from Ramat Hovav in southern Israel to the Nitzana crossing on the Israeli-Egyptian border.

When completed in 2028, the infrastructure will deliver a total of 130 billion cubic metres of natural gas from Israel’s giant, Chevron-operated Leviathan field to Egypt through 2040.

The Israeli government approved the $35 billion gas deal in August. Supplies will start in 2026.

These projects are designed to meet rising industrial demand and support Egypt’s export ambitions.

Is Egypt re-emerging in the global energy play?

Egypt is actively repositioning itself as a key gas hub in the North African and Middle Eastern region.

Despite recent setbacks, the country remains committed to revitalising its gas sector and reclaiming its role as a regional energy powerhouse.

In 2024, Egypt experienced its sharpest drop in global LNG exports, driven by technical setbacks at the Zohr gas field—once hailed as a key parameter in its energy equation.

This decline was further compounded by geopolitical tensions, notably the military confrontation between Israel and Iran, which disrupted regional supply chains and strained Egypt’s gas infrastructure.

To bridge a widening domestic energy gap, the government instructed LNG producers to temporarily defer exports until early 2025. This move, though necessary, underscored the urgency of rebalancing supply and demand.

Yet, Egypt is not standing still. The government has launched a series of reforms aimed at restoring investor confidence and accelerating exploration.

Minister of Petroleum and Mineral Resources, Karim Badawi, stated Egypt’s commitment to working hand-in-hand with international partners to unlock new reserves in high-potential zones like the Western Desert and the Mediterranean.

“We want the partners to increase their investments in local production and in discovery processes to add to reserves and output,” Badawi stated in an October interview.

More than $1.2 billion in foreign direct investment is expected to flow into over 100 exploration wells this quarter alone—a clear signal of Egypt’s determination to reignite growth.

Looking ahead, Egypt’s gas sector is projected to expand at a compound annual growth rate of 12% through 2033, defying political headwinds and positioning the country as a resilient force in the global energy arena.