No doubt, Trump’s return to the White House has energised Africa’s oil ambitions—but it’s casting a shadow over renewable energy progress across the continent.

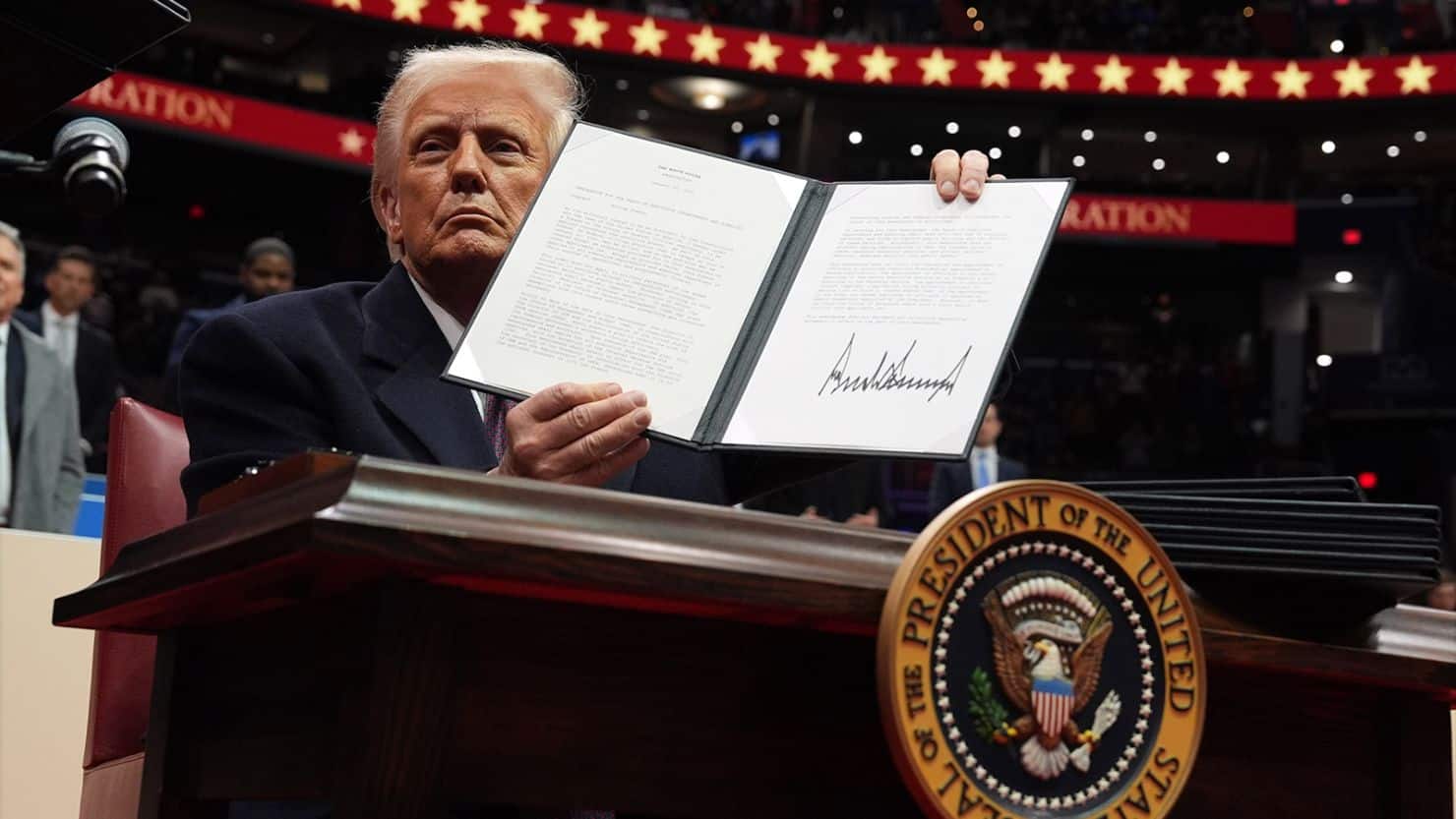

In his second term, President Donald Trump has reignited a fossil fuel-first energy agenda that’s already rippling across Africa as much as it does across elsewhere.

For petroleum-producing nations like Nigeria, Angola, Ghana, and Mozambique, this shift is being treated both as another opportune moment and a lifeline for stalled projects and fresh investment.

But for climate advocates and renewable energy developers, it sounds a different note.

They call it a setback moment that could slow the transition to cleaner energy for Africa, where over 600 million people still lack access to reliable electricity

This article explores how one presidency could tilt Africa’s energy future—for better or worse.

How is Trump’s second term favouring fossil fuels?

Trump’s administration has reversed many of the climate-focused policies of his predecessor, prioritizing oil and gas expansion over renewables.

The U.S., already the world’s largest producer of crude oil and natural gas, is now doubling down on domestic drilling, pipeline approvals, and deregulation.

This shift is having wide-reaching effects on global energy markets.

The U.S. has expanded drilling on federal lands and offshore zones, including previously protected areas like parts of the Arctic National Wildlife Refuge.

Fracking and shale production have surged, reinforcing America’s role as a top exporter of liquefied natural gas (LNG) and crude oil.

Although this increased supply has added downward pressure on global oil prices, especially in oversupplied markets, it has motivated several oil and gas rich African countries and IOCS to recalibrate their energy strategies to align with Washington’s fossil-first agenda.

While crude prices briefly spiked following sanctions announcements, they quickly stabilized due to oversupply and speculative trading corrections.

Renewed optimism for Africa’s energy projects

Africa’s oil and gas sector is experiencing a resurgence in investor confidence, driven by the U.S. pivot back to fossil fuels under President Trump.

Energy analysts say this shift is unlocking fresh funding and technical support for African ventures—particularly from American companies that had previously scaled back due to environmental constraints.

Crucially, the policy reversal has restored momentum for fossil fuel development across the continent. In Nigeria, international oil companies (IOCs) are re-engaging with long-delayed projects like Brass LNG and deepwater exploration blocks.

Since divesting its onshore assets to Renaissance Energy Group for $2.4 billion in 2024, Shell has announced plans for a number of offshore developments. TotalEnergies and other local players are also ramping up upstream activity.

Libya, once sidelined by Big Oil due to prolonged conflict, is regaining traction.

With the largest proven oil reserves in Africa, the country is attracting foreign interest again.

More than 30 companies (including ExxonMobil, Chevron, TotalEnergies, and Eni) participated in Libya’s 2025 oil bid round, the first since 2007.

Perhaps the clearest signal of Trump’s impact is the swift reapproval of a $4.7 billion loan from the U.S. Export-Import Bank for TotalEnergies’ LNG project in Mozambique.

Initially approved during Trump’s first term, the loan was frozen under the Biden administration due to environmental and security concerns.

Its revival now serves as a green light for other stalled or delayed fossil fuel projects across Africa.

The renewable setback for Africa

While oil producers cheer Trump’s fossil-first agenda, Africa’s clean energy progress faces serious headwinds.

The continent had made notable gains in solar, wind, and hydro—largely backed by international climate finance and U.S. partnerships.

But Trump’s withdrawal from global climate initiatives and skepticism toward renewables have stalled momentum, especially in countries dependent on American aid.

In February 2025, Trump ended the $9.7 billion Power Africa initiative, originally launched by President Barack Obama to add 30GW of clean power and connect 60 million homes and businesses.

Despite 150 projects reaching financial closure by 2023, Trump accused USAID of wasting taxpayer money and placed hundreds of staff on leave.

Plans to cut funding to the African Development Bank followed, threatening a $500 million shortfall.

With the U.S. pulling back, African nations now struggle to meet emissions targets and secure financing for sustainable transitions.

Meanwhile, Big Oil—especially BP—is scaling down renewable investments in Africa, citing poor returns and shifting investor sentiment.

Capital is flowing back to oil and gas, leaving a widening clean energy funding gap.

This is especially troubling given Africa’s extreme vulnerability to climate change, despite contributing the least to global emissions.

Is Africa re-aligning strategically?

In response to shifting global energy dynamics, several African leaders are recalibrating their energy strategies.

The renewed U.S. appetite for fossil fuels is helping to boost national revenues, create jobs, and stabilize energy supply.

Despite this pivot, Europe and Asia continue to be vital markets for African hydrocarbon exports.

Asia has long driven global gas demand, while European countries, eager to reduce dependence on Russian energy, are increasingly turning to Africa and the Americas for LNG.

Recent developments suggest this trend. In September, Bayo Ojulari, Group Chief Executive Officer of Nigeria’s NNPC, revealed that up to 60% of Nigeria’s LNG production now goes to Portugal and Spain.

“We want to take advantage of the current high energy demand, which is also expected to go even higher,” Ojulari said.

This marks a significant shift for Nigeria, which in 2024 exported nearly half its gas to Asia and about one-third to Europe.

Nigeria remains one of Africa’s top LNG exporters, alongside Egypt, Algeria, and Mozambique. Mozambique, in particular, is emerging as a major player.

Since Eni launched the Coral Sul LNG project in 2022, the country has been working to bring three additional projects online, though progress has been slowed by security challenges.

Just weeks ago, Eni sanctioned its second gas project, Coral Norte. Meanwhile, TotalEnergies has announced it will move forward with its long-delayed $25 billion onshore LNG project, expected to deliver over 13 million tons of LNG annually.

Nearly 90% of that output is already contracted to China’s CNOOC, France’s EDF, and Shell, signaling strong demand from both Europe and Asia.

While these projects promise substantial economic gains, they also raise concerns about increased carbon emissions, delayed climate targets, and long-term environmental risks.

This shows that Africa’s strategic re-alignment is not without trade-offs.

The bottom line

Trump’s energy agenda is a double-edged sword for Africa.

On one side, it offers short-term economic gains for oil-rich nations—boosting revenues, jobs, and energy supply.

On the other, it threatens to derail long-term sustainability goals by sidelining solar, wind, and green innovation just as momentum was building.

As global energy dynamics shift, African countries must strike a careful balance between fossil fuel development and climate resilience.

The question remains: is the short-term boost worth the long-term cost?

To meet ambitious targets like Mission 300, which aims to connect 300 million Africans to electricity by 2030, institutions such as the African Development Bank (AfDB), World Bank, and Africa50 must step up.

Strengthening partnerships with non-U.S. donors like the European Union and China, while mobilizing private sector investment, will be key.

This is going to be an insurmountable challenge; especially now, when many international oil companies that once championed climate goals are pivoting back to fossil fuels to ride the current global oil boom.