Nigeria’s indigenous oil and gas major, Aradel Holdings, recorded a 352.9% increase in staff salary payments in 2024, disbursing a total of N21 billion, up from the previous year.

This was disclosed in the company’s full-year unaudited financial report posted on the Nigerian Exchange (NGX) and obtained by Energy in Africa.

The oil firm, whose revenue surged by 162.7% to N581.2 billion in the same period, spent N53.9 billion on general and administrative (G&A) expenses. Among these, N5.5 billion was allocated to professional fees, covering payments to external consultants, advisors, and auditors.

Additionally, other expenses under G&A costs rose to N11.9 billion, reflecting an over 100% increase, which the company attributed to currency devaluation.

Mergers and acquisitions in 2024

Aradel had an active year in mergers and acquisitions (M&A), which contributed to its revenue and profit growth. The company expanded its portfolio through majority and minority acquisitions across various assets.

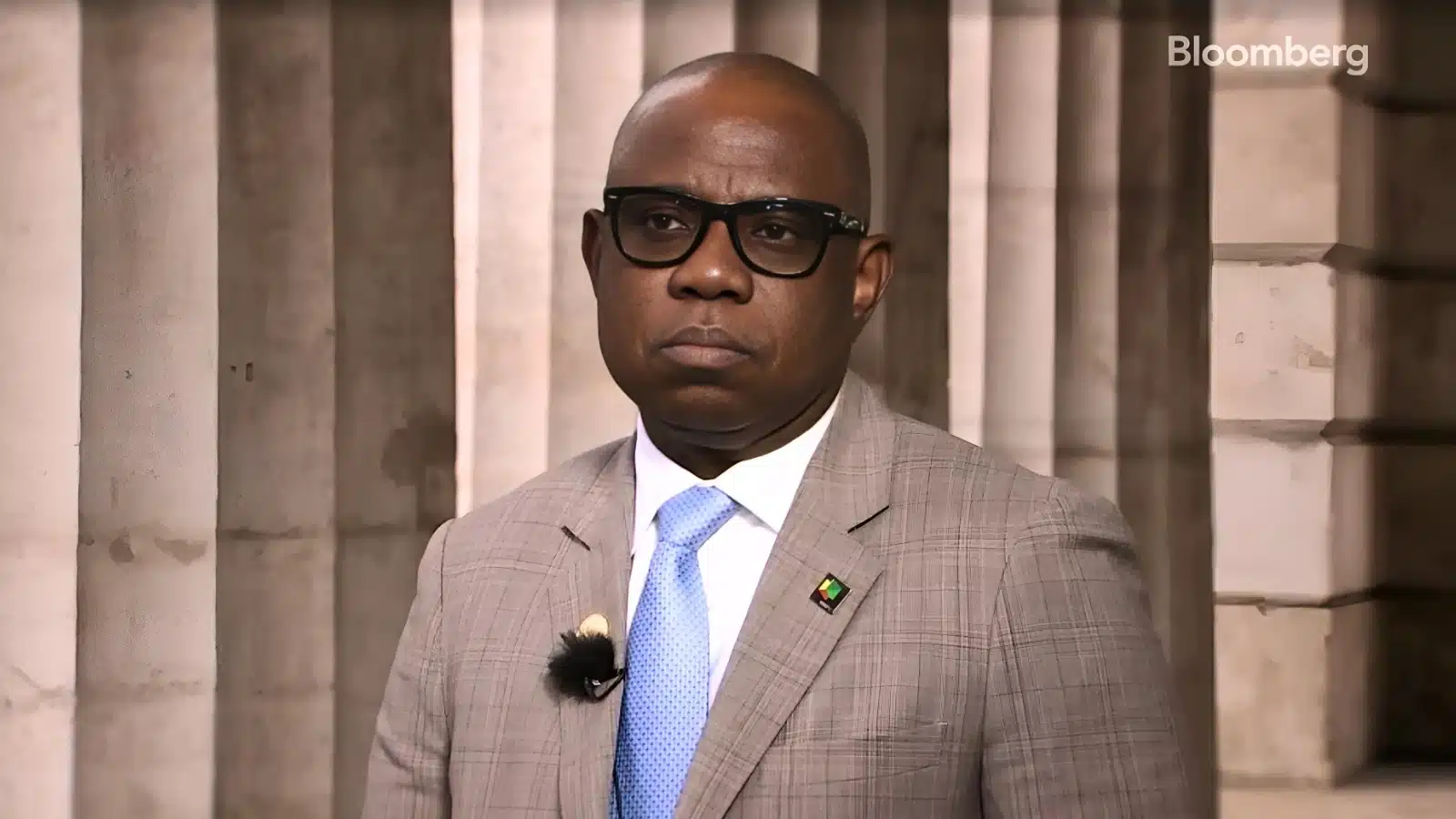

In May 2024, Aradel acquired a majority stake in First Oil, a move that boosted hydrocarbon production. Commenting on the acquisition, CEO Adegbite Falade noted that it led to an increase in drilling activity, including the successful re-entry of Well 2ST in the Omerelu oil field.

“We successfully drilled Wells 14 and 15, marking the conclusion of our Phase 1, four-well turnkey drilling campaign with favourable results. We kicked off the second phase of the drilling campaign with Well 16, which is approaching completion,” Falade stated.

Aradel also completed the acquisition of the Olo and Olo West Marginal Fields from the TotalEnergies/NNPC Joint Venture and secured a minority equity stake in Chappal Energies Mauritius Limited, an energy investment firm focused on brownfield upstream opportunities in Africa.

A significant acquisition in 2024 was the 100% equity stake in Shell Petroleum Development Company (SPDC) Limited.

Aradel, along with four other oil firms, formed a consortium that acquired Shell’s onshore assets for $2.4 billion. The deal has received ministerial approval but is still awaiting final clearance from the federal government.

The Shell acquisition is expected to strengthen Aradel’s position in Nigeria’s oil sector, though it also marks Shell’s exit from the country’s onshore operations.

2025 growth plans

Looking ahead, Aradel plans to focus on developing the Olo, Olo West, and Omerelu fields in 2025. The company is also targeting optimized production from the Ogbele field, aiming for an annual output of 16,000 barrels per day (bpd) and 50 million standard cubic feet per day (mmscf/d) of gas.

“These are in addition to optimizing production from Ogbele, with a target annual production of 16 kbbls per day and 50 mmscf per day,” the financial statement read.

Financial performance and rising Costs

Moreover Aradel reported a 162.7% increase in revenue, reaching N581.0 billion in FY 2024, up from N221.1 billion the previous year. This growth was driven by a 244.6% increase in export crude oil revenue to N373.7 billion, aided by improved production and the better utilization of the Trans Niger Pipeline (TNP) and Alternative Crude Evacuation (ACE) route.

On the other hand, gas revenue rose 174.7% to N28.0 billion, while refined product sales increased 74.9% to N179.3 billion, supported by higher sales volumes.

However, the company also faced rising costs, with Cost of Sales (COS) soaring 231.4% to N261.2 billion. The main cost drivers included a 241.1% rise in crude handling charges to N97.9 billion, reflecting higher activity across TNP and ACE, and a 406.9% increase in depreciation to N74.2 billion, driven by higher hydrocarbon production and new well costs.

Statutory expenses, including royalties, grew by 202.8% to N53.6 billion, in line with higher production levels. Meanwhile, stock adjustments resulted in a N27.6 billion credit, reflecting increased inventory.

Despite these rising costs, Aradel’s financial performance highlights strong operational growth and improved crude evacuation efficiency, positioning it for further expansion in the Nigerian oil and gas sector.