South Africa’s energy regulator on Thursday granted state power utility, Eskom Holdings, an average tariff increase of 12.7% for 2025/2026, a third of what the debt-laden company had requested.

The National Energy Regulator of South Africa (NERSA) made this announcement in a press statement, saying that while Eskom proposed a tariff increase of 36.15% in the 2025/2026 financial year, it approved an increase of 12.7%, a third of what was requested.

Eskom, the recipient of a 250 billion rand ($13.5 billion) government bailout, asked the regulator to raise tariffs by more than 36% to avoid having to ask for more state funding.

In a report by South Africa’s Auditor- General, Eskom Holdings financial survival is at risk due to the utility’s inability to resolve its most pressing financial crisis which is municipal debt that has topped 95 billion rand ($5.2 billion).

NERSA also approved a 5.36% and 6.19% tariff increase in 2026/2027 and 2027/2028 financial years respectively, significantly lower than 11% and 9% which Eskom requested.

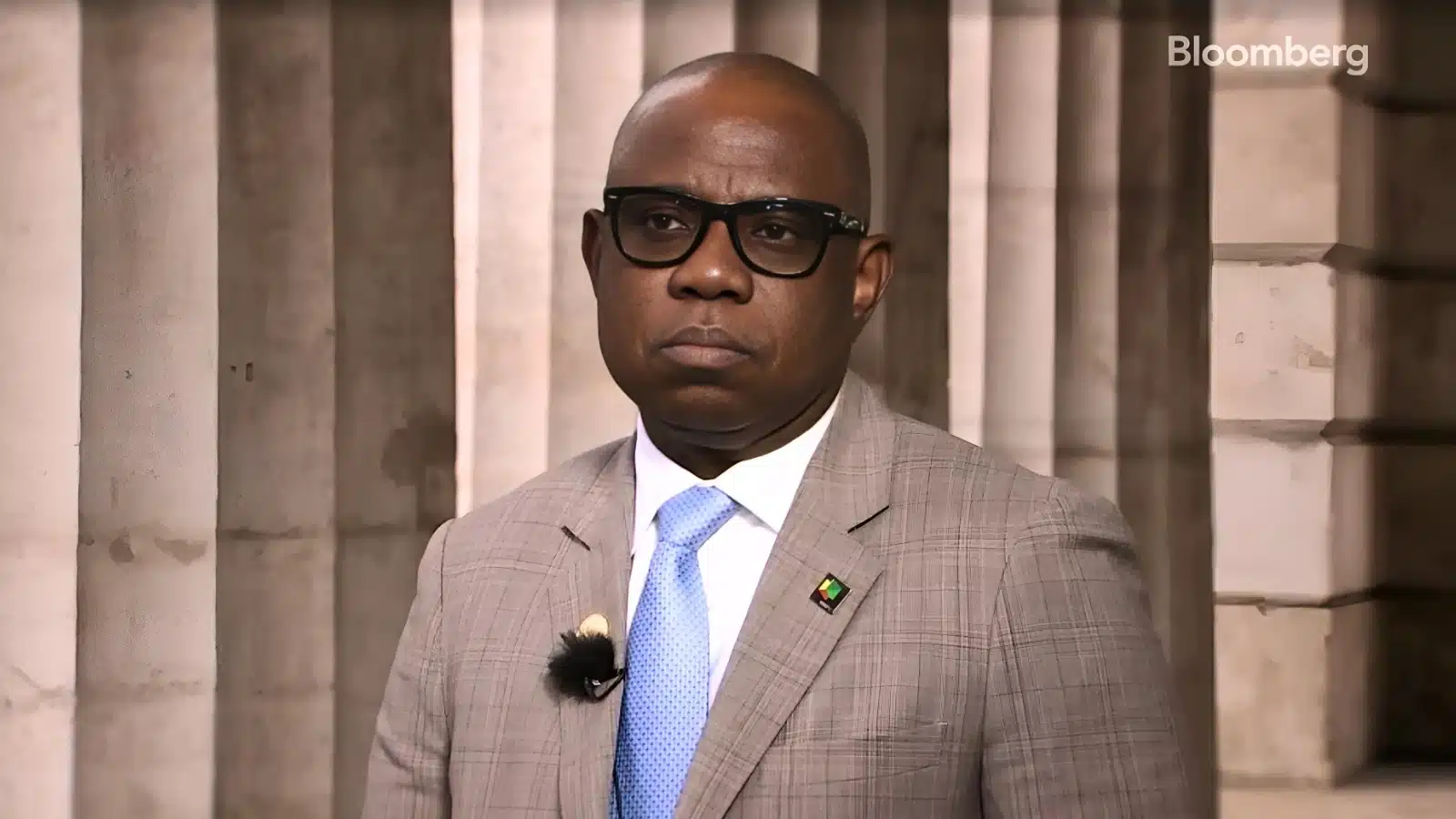

“We are required to ensure that Eskom is sustainable within the short and the long term. At the same time, we are required to ensure that the electricity services that Eskom provides are affordable,” said Thembani Bukula, chairman of the National Energy Regulator of South Africa (NERSA).

“We believe that this decision strikes a necessary balance between the needs of Eskom and the financial realities of consumers.”

The regulator’s decision effectively denies Eskom tens of billions of rand that the company said it needs to deal with coal contracts, a higher carbon tax and rising debt from municipalities.

Commenting on the decision by the energy regulator, South African energy minister, Kgosientsho Ramokgopa, in a statement welcomed NERSA’s decision on tariff adjustments for Eskom Holdings.

“We welcome the fact that these tariff adjustments take into account the need to mitigate inflationary pressures on communities and businesses”, Minister Ramokgopa said.

The Minister also reaffirmed his confidence in NERSA’s independence and commitment to balancing Eskom’s financial stability with the economic realities faced by consumers, businesses and industries.

Although Eskom Holdings has gone 300 days without implementing power cuts that has plagued South Africa’s economy for years, it has significant financial issues that need to be addressed.

Despite projecting financial gains for 2025, the company needs higher revenues to stabilise its financial standing.