The Nigerian government has officially approved the sale of Shell Plc’s onshore assets to Renaissance Group for $2.3 billion.

This approval was disclosed in a statement released by Renaissance Group on Wednesday and reported by Reuters.

According to Renaissance, the approval represents a major milestone following the announcement of the sale and purchase agreements earlier this year.

“This approval marks a significant step forward from the announcement of the sale and purchase agreements in January,” Renaissance said.

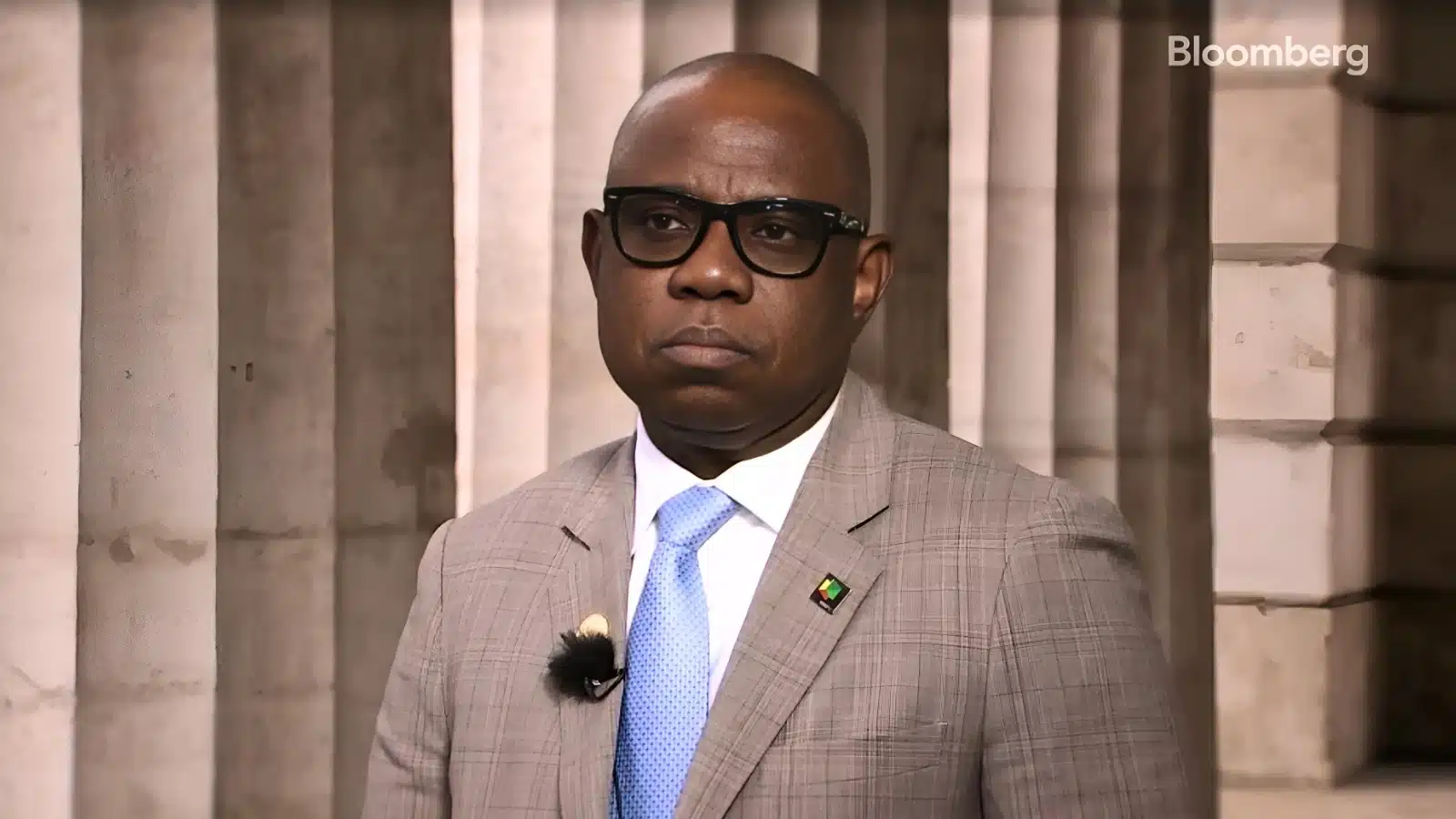

In addition, Aradel, a key shareholder in the consortium of five companies that formed Renaissance, confirmed that the Minister of Petroleum Resources (Oil), Heineken Lokpobiri, approved the deal.

In a statement by its managing director, Adegbite Falade, Aradel acknowledged Lokpobiri’s consent to the sale of the assets.

“Aradel Holdings Plc (‘Aradel’), listed on the Nigerian Exchange Limited, is pleased to announce that the Minister of Petroleum Resources has granted his consent to the sale of The Shell Petroleum Development Company (SPDC) to Renaissance Africa Energy Limited (‘Renaissance’).

“For Aradel, as a shareholder in Renaissance, this approval marks a significant step forward from the announcement of the Sale and Purchase Agreements in January 2024. Further details will be provided in due course,” Falade stated.

Earlier rejection from oil regulator

Meanwhile, the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), the regulatory body overseeing such transactions in the oil and gas sector, had previously rejected Renaissance’s bid to acquire Shell’s assets, citing concerns about the consortium’s capacity to manage the assets.

Shell has operated onshore in Nigeria for nearly 100 years, making it one of the country’s oldest energy companies.

The company’s shallow-water assets in Nigeria are estimated to contain approximately 6.73 billion barrels of oil and condensate and 56.27 trillion cubic feet of gas.

Over the years, Shell has faced numerous lawsuits from local communities alleging oil spills and environmental damage.

When the deal was first announced in January, Shell indicated that Renaissance would assume responsibility for addressing damages caused by spills in the Niger Delta region. However, local communities said they expect Shell to play their part in continuing the cleanup programme and resolve its ongoing lawsuits.

Key details of Shell onshore assets

Shell’s SPDC Limited, the onshore assets of Shell, operates and holds a 30% stake in the SPDC joint venture, which manages 18 onshore and shallow-water mining leases.

Other partners in the joint venture include the Nigerian National Petroleum Corporation (NNPC), which owns 55%, TotalEnergies with 10%, and Italy’s Eni with 5%.

In addition to its operations in various deep offshore fields, Shell retains a liquefied natural gas plant and other assets in Nigeria.

Formed in 1979, SPDC incorporated the assets of the older Shell-BP consortium, with its current partners joining at later stages.