Nigeria may experience a decline in oil revenue as the country ramps up supply to Dangote refinery, a new report shows.

The latest market tracking data obtained from Reuters shows that local demand for Nigeria’s crude has caused traders to price it lower.

In addition, the national oil company, NNPC, is expected to increase its supply in September to the Dangote refinery, diverting five Nigerian cargoes to the 650,000 bpd plant.

As a result, export of four key Nigerian crude oil grades will average around 758,000 barrels per day in September.

This is in contrast to the 864,000 bpd scheduled to load in August.

On their part, the increase in supply to Dangote refinery means traders are still figuring out how much crude will be left for export.

The report indicates that recently, Nigerian oil sellers were offering:

- Bonny Light at $2.60 more than the standard Brent price

- Forcados at $4.25 more than the Brent price

But as exports drop further, the price may dip in the coming months.

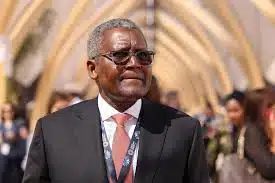

Nigeria’s Dangote supply

Earlier, the leadership of Dangote refinery had said the company would buy more of Nigeria’s crude, with a projection to refine only Nigerian crude by December.

This increase, while it means more supply for local producers, also results in a decrease in oil earnings.

Nigeria earns about 80% of its foreign revenue from oil exports.

Meanwhile, the country initiated a Naira-for-Crude policy for local refineries to help drive domestic output.

This means Nigeria doesn’t earn as much as it should from its crude.

Moreover, market projections indicate that the price difference between standard oil and Nigeria’s sweet crude is likely to weaken, a trader said, citing a seasonal drop in demand.

The Dangote refinery began production in 2024 and has reached about 85% of its capacity.

The plant projects to refine all of Nigeria’s crude oil by 2030, meeting local needs and exporting to neighbouring countries.