The management of Dangote Group has clarified that the $1 billion the Nigerian National Petroleum Corporation (NNPC) Limited borrowed from a financier was not intended for “supporting” the refinery but was instead an investment to acquire a stake in it.

In a statement on Wednesday, the Group’s spokesperson, Anthony Chiejina, dismissed claims that the NNPC borrowed the loan to address liquidity challenges at the refinery as completely false.

Chiejina emphasized that the 650,000 barrels per day (bpd) mega petrol plant did not face liquidity issues during the transaction, noting that the agreement was specifically for a 5% stake in the refinery.

He explained that Dangote allowed the national oil company to pay in two tranches, both in cash and through credit in crude oil supply, although the NNPC was unable to fulfill the latter obligation.

“As at 2021 when the agreement was signed, the refinery was at the pre-commission stage. In addition, if we were struggling with liquidity issue, this agreement would have been cash based rather than credit driven.

“It is, therefore, inaccurate to claim that NNPCL facilitated a $1 billion investment amid liquidity challenges. Like all business partners, NNPCL invested $1 billion in the refinery to acquire an ownership stake of 7.24% stake that is beneficial to its interests,” Chiejina said.

In an earlier report, the national oil company had stated that it borrowed a sum of $1 billion to support Dangote refinery as part of its interest in the petrochemical plant.

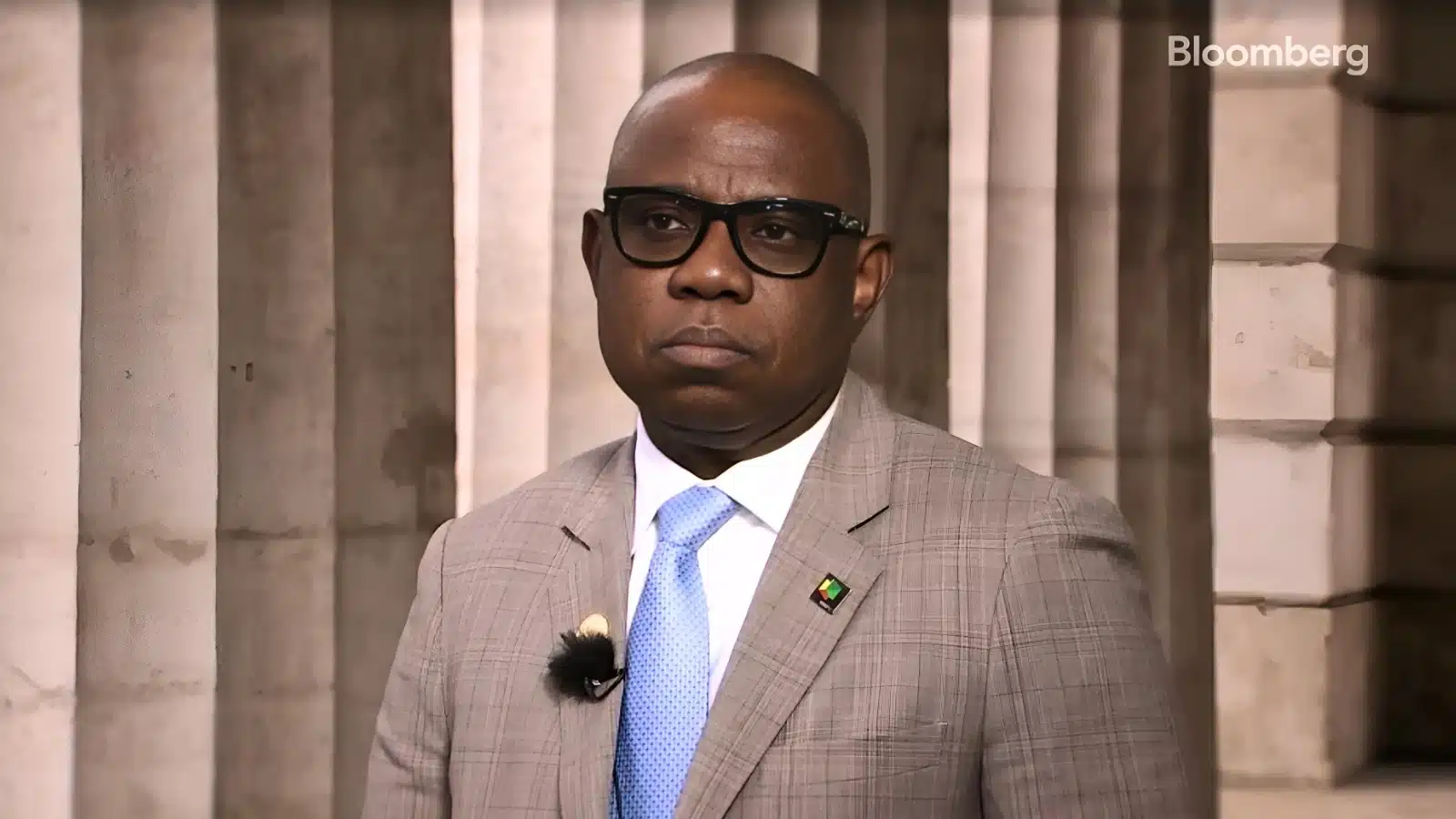

NNPC’s Head of Corporate Communications, Olufemi Soneye, made the disclosure during his remarks at the Energy Relations Stakeholder Engagement in Abuja.

“A strategic decision to secure a $1bn loan backed by NNPC’s crude was instrumental in supporting the Dangote Refinery during liquidity challenges, paving the way for the establishment of Nigeria’s first private refinery,” Soneye said.

Meanwhile, Dangote said that is not the case, adding that the finance was meant only to acquire equity investment in the refinery.