South African petrochemical company Sasol has projected a decline of up to 36% in its earnings for the first half of the financial year. The company attributed the expected drop to challenging market conditions and lower chemical prices.

Sasol announced the forecast on Wednesday in a report published on Reuters, highlighting the impact of weaker global demand and fluctuating energy costs on its performance.

Sasol attributed the profit decline to lower oil prices and reduced sales volumes. Revenue was also impacted by a 5% drop in sales, driven by decreased production and weaker market demand.

In a trade update, Sasol stated that it anticipates its headline profits per share (HEPS), a commonly used profit metric in South Africa, to fall from 20.37 rand to 13 rand ($0.6955-$0.8025) during the same period last year.

The company, which turns coal and gas into chemicals and liquid fuels, said the decline was mostly caused by a 13% drop in the average price of a barrel of Brent crude oil, together with a notable decline in refining margins and fuel pricing differentials.

This forecast was closely followed by Sasol’s cooperative development agreement at the annual African Mining Indaba in Cape Town, partnering with De Beers to pilot the production of renewable diesel from vegetable oil and explore sustainable diesel manufacturing.

Despite the fact that South Africa’s renewable diesel production is not yet commercially viable, Sasol claims that the country’s renewable fuels industry is promising due to consumer demand and decarbonisation goals.

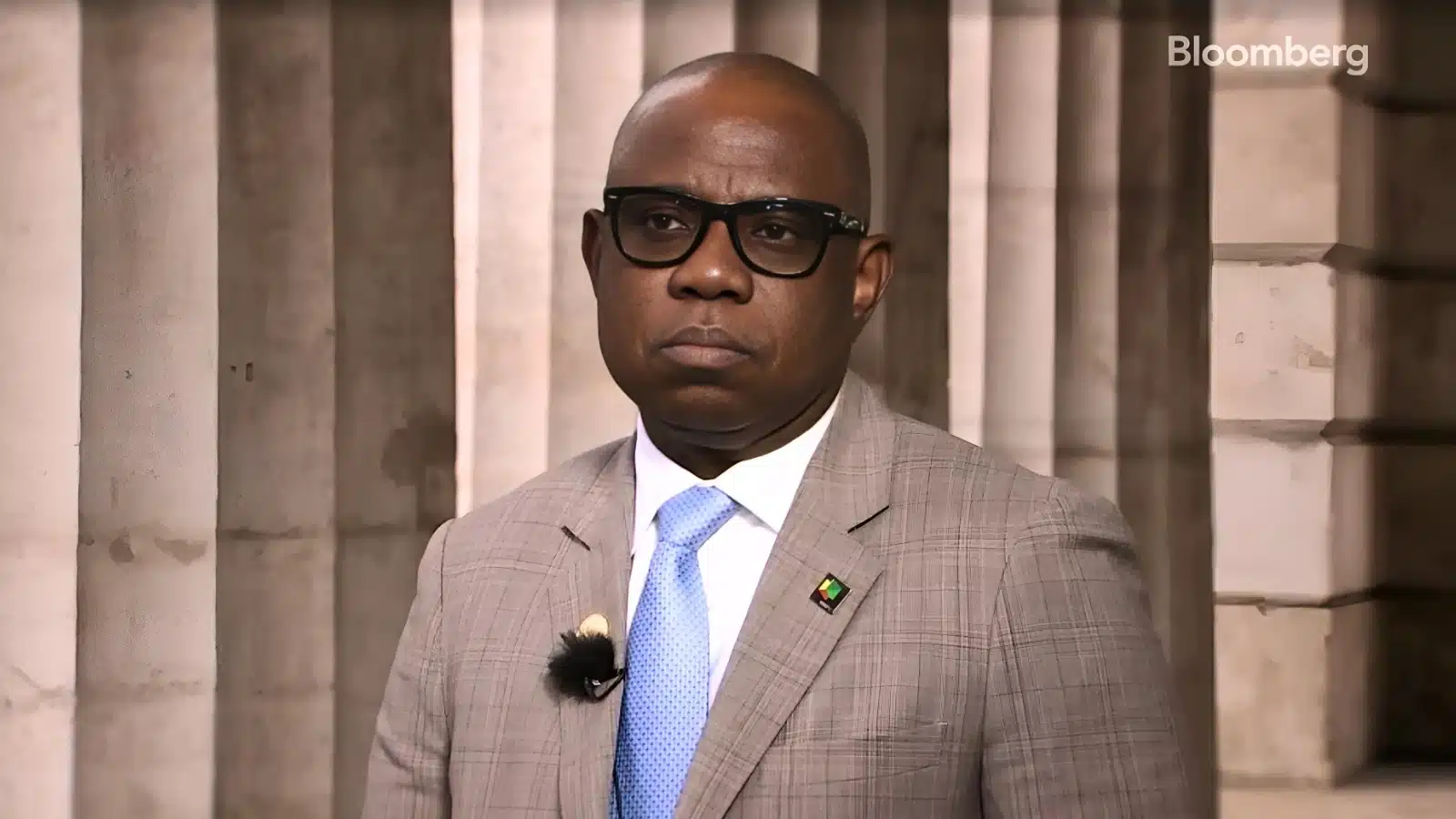

Sarushen Pillay, executive vice president at Sasol, further commented at the signing ceremony, saying:

“Renewable diesel is transformative. It meets the technical standards of conventional diesel while significantly reducing greenhouse gas emissions.”