Ghana’s energy sector is known for its frequent and unpredictable power outages.

This recurring challenge was named “Dumsor,” a term derived from the Akan language meaning “off-on,” which was described by President John Dramani Mahama during his inauguration, acknowledging the severity of the crisis.

The term, popularised since 2012, evokes frustration among Ghanaians due to its impact on households, businesses, and economic growth.

As the nation grapples with about $3.1 billion energy sector debt as of March 2025 and ageing infrastructure, opinions on resolving Dumsor vary widely among citizens, government officials, private sector leaders, and experts.

The root cause of dumsor

Dumsor is the combination of fuel supply shortages, financial mismanagement, and infrastructural deficiencies.

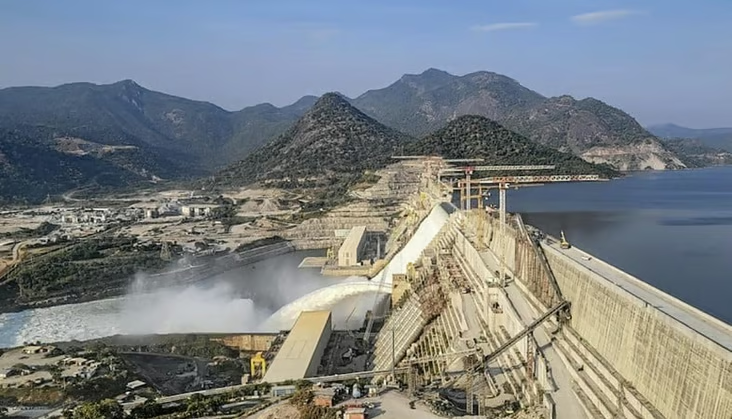

According to the International Energy Agency, Ghana’s electricity mix relies on 63% natural gas and 34% hydropower, primarily from the Akosombo Dam, but supply remains unreliable, particularly in rural areas.

Built in the 1920s and revamped in the 1950s, the struggles to meet rising demand were driven by urbanization and population growth.

The Volta River Authority (VRA) and Ghana Grid Company (GRIDCo) manage most power generation and transmission, while the Electricity Company of Ghana (ECG) and Northern Electricity Distribution Company (NEDCo) handle distribution.

However, unpaid bills, with ECG reporting $1.6 billion owed by private producers and $1.8 million by Parliament alone.

John Abdulai Jinapor, Minister of Energy, said that the previous administration’s failure to secure adequate fuel supplies left the sector vulnerable.

Therefore, fuel supply challenges are compounded by Ghana’s dependence on imported gas from Nigeria via the West African Gas Pipeline, which faces disruptions due to maintenance and unpaid debts.

How does the government plan to address Dumsor?

The National Democratic Congress (NDC) government, under President Mahama, has pledged to resolve Dumsor permanently.

Jinapor assured citizens that the ongoing power disruptions would stabilize within two weeks through emergency fuel procurement and infrastructure upgrades.

The government introduced the Energy Sector Levy (Amendment) Bill, 2025, on June 3, 2025, imposing a GHC1 ($0.098) per liter tax on petroleum products to raise GHC5.7 billion ($556 million) for fuel purchases and debt repayment

John Abdulai Jinapor, Minister of Energy, emphasized that this “Dumsor Levy” addresses over a $1 billion fuel procurement need for 2025, as liquid fuel costs are excluded from the current electricity tariffs.

Mahama also announced an emergency meeting with power sector stakeholders to address fuel shortages, blaming the previous New Patriotic Party (NPP) administration for neglecting long-term planning.

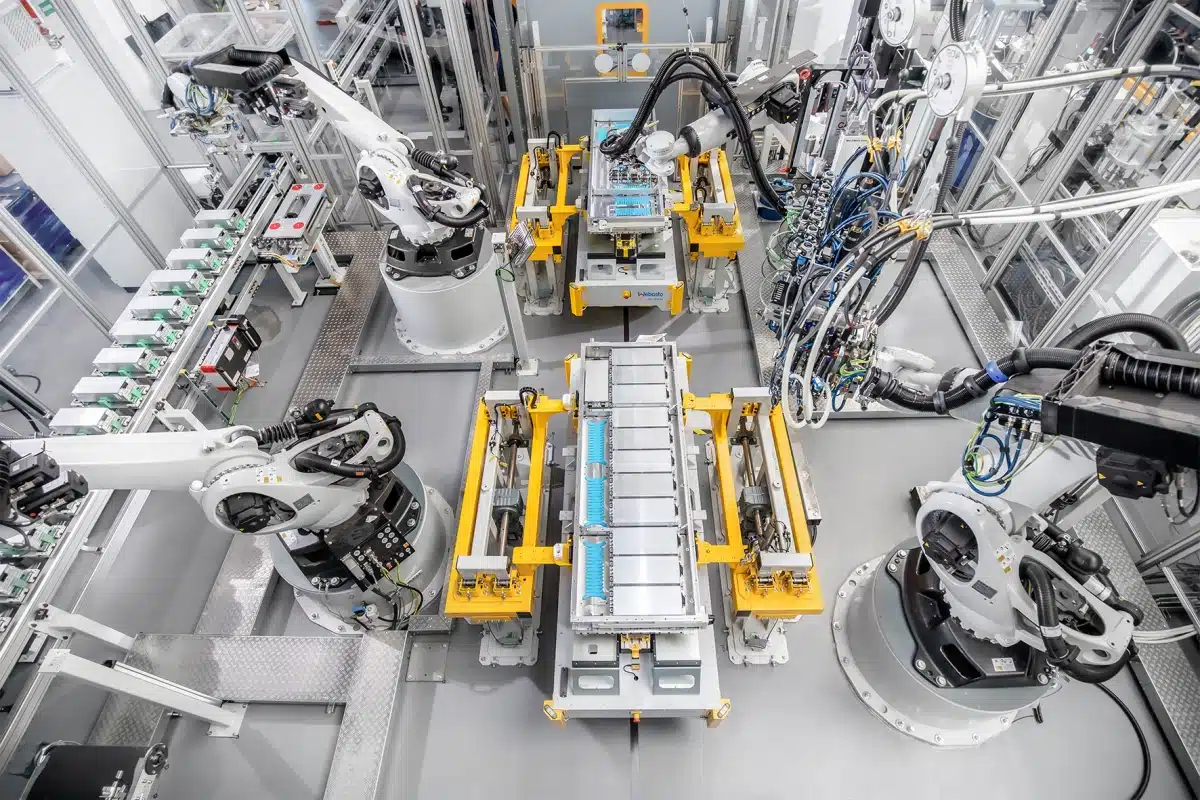

The government plans to diversify energy sources, including renewables, and improve ECG’s billing efficiency through private sector involvement.

However, John Jinapor argues that political interference in power generation and distribution hinders progress.

Ghanaians’ response to the government’s plan to stop Dumsor

Many Ghanaians view the Dumsor Levy as a betrayal of the NDC’s campaign promise to eliminate “nuisance taxes” like the E-Levy.

A member of parliament of Effia and a member of the finance committee of parliament, Isaac Bomah-Nyarko,

Criticised the NDC and President Mahama’s administration over the newly-approved 1% energy levy on petroleum products, describing it as a betrayal of public trust.

“The energy minister is trying to reintroduce some partnership to ECG and bring in the private sector.”

“If there is a need to create some monetary space to pay for energy sector debts, do we need the GHC1 ($0.098) per litre?” he asked.

In addition, the Minority Caucus in Parliament has condemned the new GHC1 ($0.098) dumsor levy, describing it as a “predatory, insensitive, and dishonest” tax that will impose severe hardship on Ghanaians already battling economic pressure.

The Senior Vice President of IMANI-Africa, Kofi Bentil, spoke against the John Mahama-led government over the recent Energy Sector Levy.

“The NDC government must sit up and do their work as nobody cares about their explanation,” He said.

Former Vice President Mahamudu Bawumia argues that the D-Levy is disproportionately burdensome.

Bawumia claimed it is “eight times worse” than the E-Levy, noting that GHC1,000 ($97.6) worth of fuel now attracts GHC83 ($8.10) in taxes compared to GHC10 ($0.98) under the E-Levy.

Economist and finance expert, Godfred Bokpin of the University of Ghana, also supported Mahamudu Bawumia’s recent criticism of the newly introduced Dumsor Levy by the NDC government

In addition, energy Expert Kwame Jantuah has stated that, as difficult as it is dumsor levy is a necessary evil.

Some public transport drivers also voiced their complaints during a street interview by Ghana Web.

“It’s unfair on drivers, we were asked to reduce transport fares due to government directives, and now we are taxed for fuel purchase, which would affect transport fares again.

So why the tax? Everyone should be taxed, including private and government sectors”, they said.

Reactions on social media and in public debate are split along similar lines.

Some Ghanaians are torn on how to stop the dumsor levy because some may have welcomed the levy as a prudent step to end power cuts,

while many others condemned it as an undue burden on ordinary commuters and businesses.

However, Finance Minister Dr. Cassiel Ato Forson defended the measure, emphasizing the critical need for funds to clear accumulated debts and finance thermal power generation in 2025.

The NDC also defended the levy as unavoidable.

Deputy Government Spokesperson Shamima Muslim urged Ghanaians to “bear with” the tax.

Noting that Ghana now has over $3 billion in energy debts that demand urgent financing.

She says that the cedi is appreciating, inflation is moderating, and pump prices have fallen, making it an opportune time to collect the levy.

Energy Minister John Jinapor similarly argued that the levy was delayed until fuel costs eased

“A sensitive government will not slap a tax when fuel was GHC16.00 ($1.56) per litre” – and now remains affordable for consumers.

Why is the levy needed to end Dumsor?

Energy Minister Jinapor emphasised that levy proceeds would be directed toward “vital infrastructural and operational needs” in the energy sector to ensure a reliable power supply, according to the Ghana Dubawa report.

The government sees the GHC1 ($0.098) levy as a temporary emergency measure to inject funds into the power system, address energy sector debts, and mitigate intermittent power supply issues facing Ghanaians.

Ghanaians do want to see the end to dumsor, but not at their expense, while some may think it’s worth the risk.

Although its economic fallout could stoke broader discontent.