Nigeria cut its imports of European gasoline by nearly half in April 2025, bringing in just 275,000 tons compared to 520,000 tons during the same period last year, according to energy analytics firm Vortexa.

The sharp drop reflects Nigeria’s ongoing push to boost domestic refining capacity and reduce its long-standing dependence on imported fuel.

This lower demand from Nigeria also contributed to a wider global decline in European petrol exports, which fell to 3.41 million tons in April 2025, down from 3.75 million tons a year earlier.

This shift is part of a broader trend across West Africa, where traders are redirecting European gasoline cargoes to offshore hubs such as Lome, Togo.

Much of this offloading involves clearing winter-grade petrol to make room for more valuable summer-grade gasoline destined for European markets.

Once one of Europe’s largest petrol customers, Nigeria is now scaling back imports due to increased refining capacity.

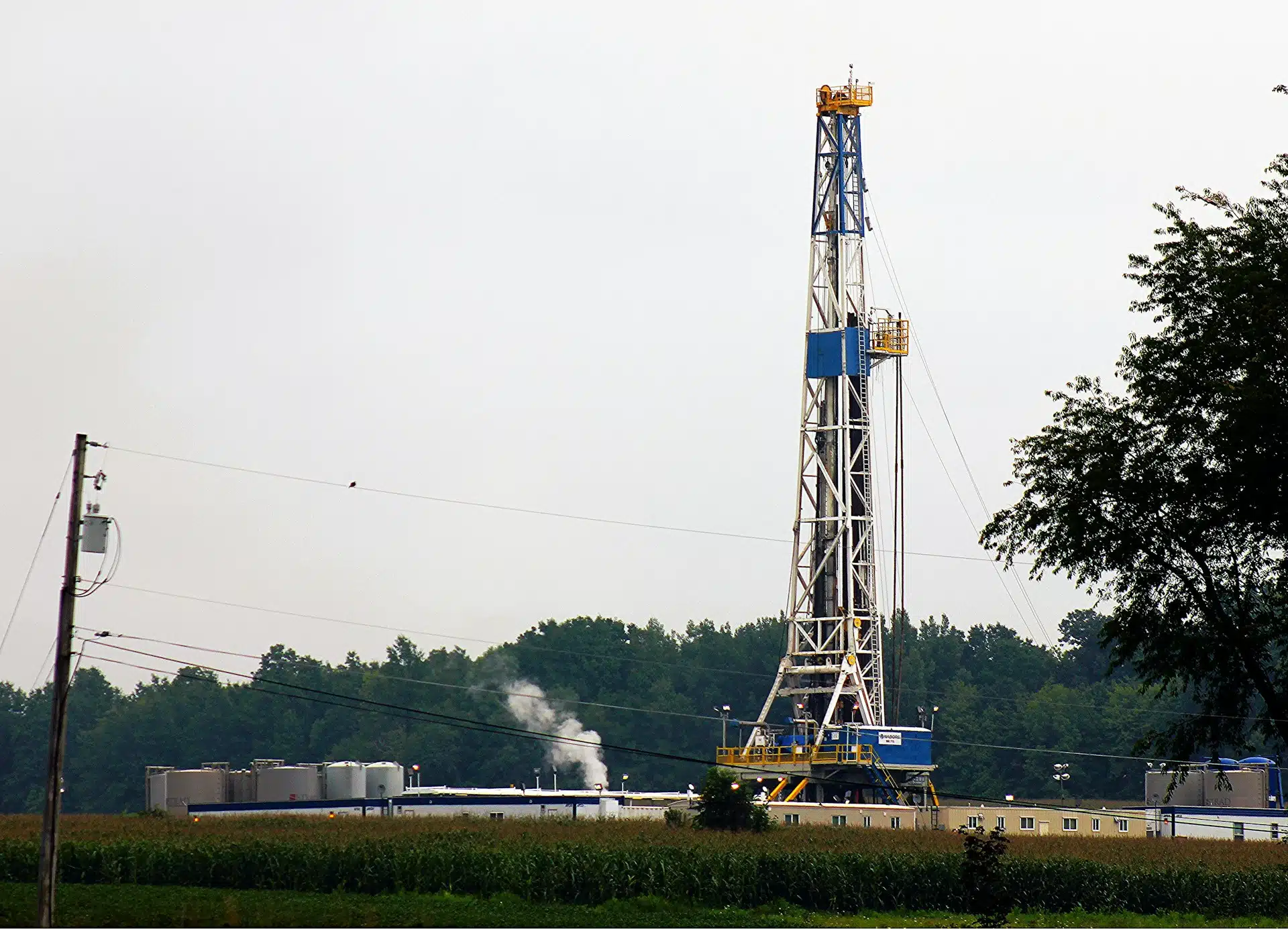

The 650,000 bpd Dangote Refinery—Africa’s largest—has begun to challenge imported fuel from the European markets.

The plant has the capability to produce nearly 90 million litres of petrol daily.

This far exceeds Nigeria’s current consumption, which averages around 50 million litres per day.

Data from the Central Bank of Nigeria (CBN) revealed the country’s petroleum import bill fell by 23.2% in 2024.

In January 2025, Nigeria’s petrol imports plunged to 110,000 barrels per day—the lowest level in eight years—thanks to supply from the Dangote plant.

Between August 2024 and April 13, 2025, Nigeria’s petrol imports dropped by over 60%, falling from 44.6 million litres per day to just 14.7 million litres, according to NMDPRA.

Analysts project further declines as more local refining facilities come online and the country accelerates its transition to compressed natural gas (CNG) in the transport sector.

Meanwhile, Canada overtook Nigeria to become Europe’s second-largest petrol export destination in April 2025.

Canadian imports surged to 345,000 tons—the highest since September 2024—driven by refinery maintenance that boosted demand for foreign fuel.

Most of the gasoline exported from Europe now originates outside the UK, following Britain’s decision to shut down all domestic fossil fuel refining.

The country closed its last remaining crude oil refinery just days ago, a move that contributed to record-low net petrol exports of only 65,000 tons, according to the Joint Organisations Data Initiative (JODI).